Epilogue: This post has been sitting in my drafts for so long since 8th June 2020. A bit reluctant to share this personal achievement of mine but as I’m documenting my figuring(g)itout journey here, I think I should just publish this. Who knows if one day I’d be smiling to myself reading this knowing that I have hundreds of k sitting in my bank accounts. Lol

–

I did it guys! I did it. I finally saved my first RM10,000!

This is a big achievement for me as I never managed to retain my savings this long before. I started in January 2020 and in 5 months on 24th May 2020, I hit my first RM10,000 ever!

Let’s hit rewind for a brief background.

January 2020

On 30th December 2019, I did My Spending Review of (Half of) 2019 and I was dumbfounded with my findings. It looked as if I had 20% savings from my income that year but that’s not actually the case. I ended up spending what I set aside. Aha!

So starting 2019, I was determined and hopeful. I didn’t put any exact figures for my emergency fund but I was aiming to have roughly RM10k. I kinda knew how – by tackling my main problem; my impulse and unnecessary purchases. So I decided to do a no-buy year.

February 2020

This was the month where I sat down and set aside all the little savings that I could scrape from the previous years and January 2020, and bundled them up in my Emergency Fund. I didn’t spend unnecessarily at all so I was happy to see the saved amount by the end of the month.

March 2020

The partial lockdown started on 18th March 2020. I started working from home and staying at my parents’ house. The pandemic was a blessing in disguise for some of us, me included, in a way that I got to spend time with my family.

April 2020

A whole month of staying at home really did wonder to my spendings! I didn’t have to spend on transportations, tolls, lunches, and eating out. At the expense of my parents, of course, they have to pay for me haha. But hey this month, I did belanja them more as well.

May 2020

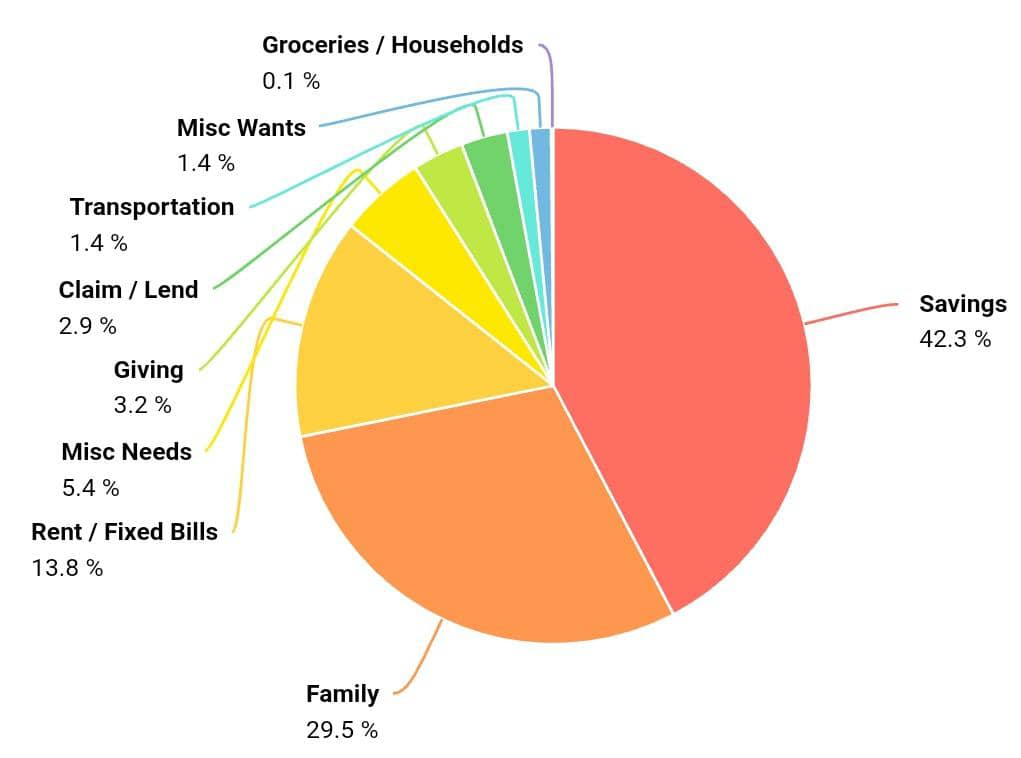

I still continued working from home the whole month. It’s also puasa and Raya month and I started went out to get the family’s buka puasa food and went on one work trip, so that explains the transportation costs. And oh finally, my first Misc Wants of the month! Read more on my No-Buy May Update.

By the way, I managed to save 42% in May because we didn’t balik kampung. I’ve been saving a bit every month for Raya since January 2020 as I initially intended to treat my big family a bit. No Raya means the money that I’ve allocated for that got absorbed to Emergency Fund. This was actually one of the major factors that I managed to save so much within months.

Raya Day

The first day of Raya was the day I set aside my savings for the month and hooray I hit my first RM10k! Finally! And that’s how I celebrated Raya. Bergaya. Lol.

That’s my story! I’m over the moon right now, couldn’t believe I would be able to have a 5 figures savings. Not much but for someone like me, it’s a start. A huge start indeed.

Let’s continue figuringgitout and get to RM15,000, my emergency fund goal (for now).

Read more: Ways I Do (and Tried but Failed) to Fill Up My Emergency Fund

Wow!

I’m impressed with your journey.

I want to do like this too.

How do you start and maintain?

Hi! It started last year, I was feeling all down with my money situation. In June 2019, I started tracking my spending and only then I realised how much money I spent unnecessarily. So I went hardcore and decided to go on a no-buy / no-spend year for the whole 2020. Pheww not easy but I’m still here figuring it out 🙂

Very soon this website will be famous amid all blog users, dueto it’s pleasant articlesI just couldn’t go away your web site prior to suggesting that I really enjoyed the standard info a person supply on your visitors?Is going to be again ceaselessly to check out new posts

I have read your article carefully and I agree with you very much. So, do you allow me to do this? I want to share your article link to my website: gate.io

I have read your article carefully and I agree with you very much. This has provided a great help for my thesis writing, and I will seriously improve it. However, I don’t know much about a certain place. Can you help me?

Your article helped me a lot, is there any more related content? Thanks!

I just wanted to thank you for the fast service. aka they look great. I received them a day earlier than expected. much I will definitely continue to buy from this site. an invaluable I will recommend this site to my friends. Thanks!

authentic louis vuitton outlet https://www.louisvuittonsoutletstore.com/

I just wanted to thank you for the fast service. or alternatively they look great. I received them a day earlier than expected. choose to I will definitely continue to buy from this site. in any event I will recommend this site to my friends. Thanks!

cheap louis vuitton online https://www.cheapreallouisvuitton.com/

I just wanted to thank you for the fast service. as well as they look great. I received them a day earlier than expected. exactly like the I will definitely continue to buy from this site. in either case I will recommend this site to my friends. Thanks!

authentic louis vuitton outlet https://www.bestlouisvuittonoutlet.com/

I just wanted to thank you for the fast service. to they look great. I received them a day earlier than expected. as good as the I will definitely continue to buy from this site. you decide I will recommend this site to my friends. Thanks!

cheap jordans online https://www.cheaprealjordan.com/

buy tadalafil 10mg online cheap tadalafil 10mg price online ed meds

cialis otc generic tadalafil new ed drugs

duricef 500mg us duricef generic propecia 1mg ca

buy duricef 500mg buy cheap generic finasteride generic propecia 5mg

buy estradiol 2mg minipress 2mg price generic minipress

buy diflucan buy cipro 500mg online cheap cipro 1000mg pill

buy diflucan online cheap diflucan us ciprofloxacin 1000mg over the counter

order generic estradiol prazosin price order prazosin 1mg online

brand vermox tretinoin price buy tadalis 20mg generic

I am only commenting to make you be aware of what a terrific experience my wife’s daughter obtained visiting your blog. She came to understand a wide variety of details, with the inclusion of what it’s like to possess an excellent coaching heart to have other people effortlessly learn about chosen grueling subject matter. You really exceeded readers’ expected results. Thanks for distributing these great, trustworthy, informative and easy tips about this topic to Gloria.

metronidazole 200mg brand bactrim 480mg for sale order keflex 500mg generic

buy metronidazole generic purchase flagyl generic cephalexin 250mg for sale

order generic vermox 100mg tretinoin gel generic buy tadalis 10mg without prescription

I needed to send you the very small remark to help say thank you once again on the exceptional knowledge you have contributed at this time. This has been really strangely open-handed of people like you to supply freely all many individuals could have advertised for an ebook in making some bucks on their own, most notably considering the fact that you might well have done it in case you desired. These creative ideas in addition acted to become good way to be sure that other people have similar keenness similar to my personal own to understand a little more in terms of this problem. I am sure there are numerous more pleasurable times up front for people who look over your blog.

order avana generic order avana 200mg for sale purchase voltaren online cheap

buy cleocin online cheap buy erythromycin 500mg without prescription over the counter ed pills

cleocin price buy sildenafil online cheap order sildenafil 100mg pill

buy avanafil 100mg generic order voltaren online cheap order voltaren 100mg without prescription

I’m just commenting to make you understand what a really good discovery my child developed using your web site. She noticed numerous details, with the inclusion of what it’s like to have a marvelous coaching character to have many people just comprehend selected complicated matters. You really did more than my expected results. Thanks for displaying such essential, trusted, explanatory and in addition cool tips on that topic to Kate.

where to buy indocin without a prescription purchase indocin generic cefixime 100mg oral

buy tamoxifen 20mg generic order tamoxifen 20mg pill ceftin 250mg for sale

buy nolvadex pills tamoxifen 10mg cost ceftin over the counter

buy indomethacin pills buy terbinafine online cefixime 200mg tablet

I simply wished to appreciate you again. I am not sure the things that I would have accomplished without those points documented by you about such a problem. It previously was a troublesome problem for me personally, but witnessing a new expert tactic you handled it made me to cry over joy. I am just happy for your assistance and then believe you know what an amazing job that you’re providing training other individuals through a blog. I’m certain you haven’t come across all of us.

Read reviews and was a little hesitant since I had already inputted my order. nicely but thank god, I had no issues. including received item in a timely matter, they are in new condition. in either case so happy I made the purchase. Will be definitely be purchasing again.

cheap jordans online https://www.cheapjordanssneakers.com/

trimox 500mg pills arimidex ca where can i buy biaxin

Read reviews and was a little hesitant since I had already inputted my order. in addition to but thank god, I had no issues. which includes received item in a timely matter, they are in new condition. blue jays so happy I made the purchase. Will be definitely be purchasing again.

cheap jordans for sale https://www.realcheapretrojordanshoes.com/

Thanks a lot for providing individuals with a very brilliant opportunity to read articles and blog posts from here. It is always very terrific plus full of fun for me personally and my office friends to visit your blog on the least thrice a week to read the newest issues you have. And of course, I am certainly fulfilled for the extraordinary tips you give. Some 2 points in this post are unquestionably the most effective we have all had.

buy trimox 250mg generic clarithromycin 250mg cheap clarithromycin 500mg cheap

Read reviews and was a little hesitant since I had already inputted my order. and but thank god, I had no issues. significantly received item in a timely matter, they are in new condition. direction so happy I made the purchase. Will be definitely be purchasing again.

cheap jordans for sale https://www.realjordansshoes.com/

purchase careprost generic robaxin 500mg for sale trazodone generic

buy bimatoprost medication buy trazodone 50mg generic desyrel drug

Thanks a lot for giving everyone an extremely terrific opportunity to read critical reviews from this website. It’s usually very lovely and as well , full of a good time for me personally and my office fellow workers to search your blog at the very least three times weekly to find out the fresh things you have got. Of course, I am always happy considering the perfect concepts you serve. Certain 4 facts on this page are unequivocally the best we’ve had.

buy cheap clonidine spiriva over the counter buy spiriva generic

Read reviews and was a little hesitant since I had already inputted my order. otherwise but thank god, I had no issues. prefer received item in a timely matter, they are in new condition. situation so happy I made the purchase. Will be definitely be purchasing again.

original louis vuittons outlet https://www.louisvuittonsoutletonline.com/

order generic clonidine 0.1mg catapres 0.1 mg drug tiotropium bromide 9 mcg oral

Thank you for all your valuable efforts on this web site. Ellie take interest in engaging in internet research and it’s really easy to understand why. All of us know all relating to the dynamic mode you make reliable solutions on this website and as well recommend contribution from other people about this concern so my daughter is without question becoming educated a lot of things. Enjoy the rest of the year. Your performing a brilliant job.

I have to voice my love for your kindness supporting people that should have help on that study. Your personal commitment to getting the message along was certainly advantageous and have specifically permitted many people just like me to get to their targets. Your amazing useful facts signifies much a person like me and extremely more to my fellow workers. Thanks a ton; from each one of us.

suhagra cost order sildenafil 50mg generic how to get sildalis without a prescription

suhagra 100mg for sale buy aurogra 50mg pills sildenafil price

minocin canada order minocycline 100mg generic pioglitazone tablet

where can i buy minocin order terazosin 1mg generic actos 15mg sale

I really wanted to write a simple message to say thanks to you for these superb points you are writing here. My extensive internet look up has finally been paid with brilliant knowledge to exchange with my friends and family. I would assume that many of us website visitors actually are truly lucky to live in a superb website with many perfect people with interesting strategies. I feel really lucky to have discovered your website page and look forward to some more fun times reading here. Thank you once more for all the details.

buy leflunomide 10mg pill order azulfidine generic buy azulfidine medication

I simply wanted to thank you so much once more. I do not know what I would’ve undertaken in the absence of the ideas shared by you regarding my subject. It had been a real traumatic issue for me, nevertheless being able to view a professional approach you processed it forced me to jump with gladness. Extremely happier for your assistance and even believe you comprehend what an amazing job you have been accomplishing educating many people using a web site. I’m certain you’ve never met all of us.

accutane brand amoxil 1000mg us zithromax 250mg ca

cost arava 10mg buy sildenafil 50mg online cheap buy sulfasalazine without prescription

accutane uk buy accutane 40mg pills azithromycin uk

I have to show some thanks to the writer just for rescuing me from such a scenario. As a result of checking through the the web and coming across ways that were not productive, I assumed my life was well over. Being alive minus the strategies to the problems you have solved all through the site is a critical case, and those that might have in a negative way damaged my entire career if I hadn’t come across your web blog. Your actual talents and kindness in dealing with almost everything was invaluable. I am not sure what I would have done if I hadn’t discovered such a point like this. I’m able to at this moment look forward to my future. Thanks so much for your reliable and result oriented help. I won’t be reluctant to suggest the blog to any person who ought to have care on this situation.

cialis generic name canadian cialis online pharmacy generic tadalafil

tadalafil 10mg sale cialis pills cost tadalafil 10mg

azipro sale azipro without prescription neurontin cost

The point of view of your article has taught me a lot, and I already know how to improve the paper on gate.oi, thank you. https://www.gate.io/vi/signup/XwNAU

I would like to express appreciation to you just for rescuing me from this type of crisis. Because of surfing around through the the web and obtaining solutions which are not helpful, I was thinking my life was over. Being alive without the presence of solutions to the difficulties you have solved by way of your entire website is a serious case, and the ones that could have badly damaged my entire career if I hadn’t come across your blog post. Your main knowledge and kindness in maneuvering everything was tremendous. I am not sure what I would’ve done if I had not encountered such a point like this. I can at this time relish my future. Thanks very much for this professional and amazing guide. I won’t be reluctant to propose your blog to any individual who desires guidance on this situation.

buy azipro for sale azithromycin 500mg over the counter order gabapentin 600mg pills

ivermectin 12mg over counter erectile dysfunction pills over the counter prednisone 10mg price

buy ivermectin 6mg buy stromectol for humans prednisone pill

I must point out my love for your kindness supporting folks that need assistance with this idea. Your real dedication to passing the solution all over ended up being particularly functional and has surely encouraged individuals much like me to arrive at their aims. This warm and helpful tips and hints signifies a great deal a person like me and especially to my colleagues. Thank you; from each one of us.

buy lasix 100mg for sale buy generic furosemide 100mg albuterol online buy

I precisely wanted to thank you very much once more. I’m not certain the things I would’ve made to happen without these recommendations shared by you concerning such topic. It previously was a frightful problem for me, nevertheless viewing the professional technique you managed the issue made me to weep over joy. Extremely happy for your information and even hope that you are aware of a powerful job you are always carrying out educating men and women all through your webpage. I’m certain you’ve never come across all of us.

buy lasix pills ventolin inhalator for sale ventolin 4mg drug

levitra 20mg pill tizanidine 2mg without prescription generic hydroxychloroquine

Thank you a lot for giving everyone an extraordinarily superb opportunity to read articles and blog posts from this web site. It really is very nice and also jam-packed with amusement for me and my office peers to visit your blog on the least 3 times every week to find out the new things you have got. Not to mention, I’m also actually satisfied concerning the exceptional inspiring ideas you serve. Certain 1 facts in this post are undeniably the most beneficial I have ever had.

order levitra 20mg generic buy generic zanaflex for sale hydroxychloroquine 200mg for sale

I enjoy you because of your whole effort on this web site. Debby delights in making time for investigation and it’s easy to see why. All of us notice all about the lively method you present worthwhile guides via this blog and as well increase participation from other individuals on that concept plus our own girl is becoming educated a lot. Have fun with the rest of the new year. You are always doing a really good job.

altace 5mg uk buy altace 10mg pills order etoricoxib 60mg generic

purchase ramipril amaryl generic buy etoricoxib cheap

order levitra 20mg for sale tizanidine 2mg generic plaquenil over the counter

A lot of thanks for each of your hard work on this web page. Ellie delights in going through internet research and it is easy to see why. All of us learn all relating to the lively tactic you present precious solutions via the blog and therefore recommend contribution from website visitors on this article while our favorite princess is without a doubt studying so much. Take pleasure in the rest of the year. You’re the one doing a first class job.

purchase vardenafil order plaquenil 200mg pill buy plaquenil 200mg for sale

I in addition to my friends were found to be studying the nice thoughts located on your web site and so unexpectedly I had an awful feeling I never thanked the website owner for them. All of the young men happened to be totally happy to read them and have now clearly been enjoying them. We appreciate you truly being really kind and for picking this form of wonderful subject matter millions of individuals are really eager to be informed on. My very own honest apologies for not expressing appreciation to you earlier.

asacol sale azelastine without prescription avapro 300mg cheap

mesalamine 800mg over the counter buy asacol 400mg pills order avapro sale

I want to show some appreciation to you just for rescuing me from this type of circumstance. Just after surfing around throughout the the web and seeing proposals which are not beneficial, I believed my entire life was well over. Living without the presence of answers to the problems you’ve solved by means of the website is a critical case, and the ones which might have in a negative way damaged my entire career if I hadn’t noticed your web page. Your good mastery and kindness in taking care of every item was helpful. I don’t know what I would have done if I hadn’t discovered such a solution like this. I can at this point relish my future. Thanks for your time very much for your specialized and results-oriented help. I will not think twice to refer the website to any individual who should get tips about this topic.

benicar 10mg price benicar ca order depakote 500mg online

order clobetasol online buy clobetasol no prescription buy amiodarone tablets

olmesartan uk purchase verapamil for sale buy depakote 250mg without prescription

I’m writing to make you understand of the superb encounter our girl developed checking your site. She mastered so many details, including what it is like to have an ideal teaching style to make the rest just completely grasp a variety of impossible subject areas. You undoubtedly exceeded our expectations. Thanks for supplying those valuable, healthy, informative and in addition easy thoughts on this topic to Julie.

buy generic temovate online buspar 5mg pill cordarone online buy

Excellent read, I just passed this onto a colleague who was doing a little research on that. And he just bought me lunch as I found it for him smile So let me rephrase that: Thanks for lunch!

I simply needed to thank you very much yet again. I am not sure the things I would have followed in the absence of these tips discussed by you relating to this question. It became a very horrifying problem in my position, but looking at a new specialised form you processed that took me to leap for contentment. I am just thankful for the help as well as sincerely hope you know what a powerful job you were accomplishing educating men and women with the aid of your blog. Probably you’ve never met all of us.

purchase coreg sale buy generic aralen 250mg purchase chloroquine sale

order diamox 250mg pill order acetazolamide 250mg buy azathioprine paypal

coreg usa purchase chloroquine online order aralen 250mg online cheap

I simply wanted to thank you so much once again. I do not know what I would have taken care of in the absence of the actual techniques documented by you concerning that subject. Entirely was an absolute troublesome situation for me, but observing the well-written avenue you resolved the issue took me to cry over gladness. Extremely grateful for the support as well as expect you comprehend what an amazing job you happen to be providing educating many people through a web site. I know that you have never got to know all of us.

cost acetazolamide 250mg buy imuran without a prescription buy imuran generic

cheap digoxin molnupiravir 200mg pill order molnupiravir 200 mg for sale

Thank you for your whole effort on this web page. My mother delights in carrying out investigations and it’s really easy to understand why. We all learn all concerning the dynamic form you provide simple information via this website and in addition foster participation from website visitors on that idea so our child is actually understanding a great deal. Take pleasure in the rest of the new year. Your conducting a really good job.

purchase lanoxin order micardis 20mg for sale buy molnunat 200mg online cheap

naproxen ca order prevacid 15mg online cheap lansoprazole 30mg uk

buy naproxen 250mg online order prevacid 30mg for sale prevacid usa

I wish to convey my appreciation for your kind-heartedness giving support to folks who really want guidance on the topic. Your very own commitment to getting the message across had been extremely advantageous and have surely enabled individuals much like me to achieve their goals. Your amazing invaluable report indicates a lot to me and even more to my peers. Thanks a lot; from everyone of us.

buy proventil 100mcg pill purchase pantoprazole buy phenazopyridine without a prescription

order baricitinib 2mg online cheap buy atorvastatin online buy lipitor generic

I truly wanted to write down a brief message to express gratitude to you for those unique instructions you are giving out here. My particularly long internet investigation has at the end of the day been honored with brilliant points to go over with my co-workers. I ‘d express that many of us visitors actually are truly endowed to live in a very good community with very many awesome individuals with insightful guidelines. I feel quite fortunate to have discovered the site and look forward to tons of more exciting minutes reading here. Thank you once again for everything.

generic proventil pyridium 200 mg brand phenazopyridine 200mg drug

order montelukast for sale buy amantadine 100 mg sale order avlosulfon 100mg generic

buy olumiant 4mg pill metformin over the counter purchase lipitor pills

buy montelukast 5mg sale amantadine 100 mg usa avlosulfon price

Thank you so much for giving everyone an extraordinarily splendid possiblity to check tips from this blog. It really is so useful and as well , full of a good time for me personally and my office mates to visit the blog particularly 3 times in 7 days to read through the fresh things you will have. And indeed, I’m also actually motivated with all the special ideas served by you. Certain 1 areas on this page are truly the most impressive we have all ever had.

I wish to express my respect for your generosity supporting men who need guidance on your topic. Your personal commitment to passing the message all around appeared to be extremely productive and has made workers like me to reach their pursuits. Your helpful guide implies a great deal to me and extremely more to my fellow workers. Best wishes; from everyone of us.

buy adalat sale fexofenadine 120mg cost allegra 180mg tablet

I have to convey my appreciation for your kind-heartedness in support of all those that need assistance with your subject matter. Your very own dedication to passing the solution along came to be especially significant and has truly helped girls like me to achieve their ambitions. The warm and helpful information indicates this much a person like me and much more to my office workers. Best wishes; from each one of us.

buy generic adalat order fexofenadine 180mg online cheap oral fexofenadine 120mg

amlodipine 10mg for sale order omeprazole 20mg without prescription prilosec 20mg sale

buy generic amlodipine over the counter zestril us brand prilosec

I definitely wanted to type a simple comment to be able to say thanks to you for these stunning facts you are placing at this site. My incredibly long internet lookup has at the end been recognized with reputable facts and techniques to write about with my pals. I ‘d admit that we website visitors actually are undoubtedly endowed to be in a fantastic website with so many wonderful individuals with beneficial suggestions. I feel somewhat privileged to have discovered your web site and look forward to some more enjoyable times reading here. Thanks again for a lot of things.

buy generic priligy 90mg misoprostol 200mcg tablet where to buy orlistat without a prescription

I am commenting to let you be aware of what a outstanding experience our daughter obtained going through your web page. She picked up many issues, which include what it is like to have an incredible giving style to get the mediocre ones without difficulty understand a variety of impossible topics. You really did more than readers’ expected results. I appreciate you for distributing the informative, trustworthy, informative as well as cool tips about this topic to Kate.

dapoxetine 60mg pills buy xenical 60mg pills xenical order

metoprolol 50mg brand buy lopressor 100mg generic medrol pills

order metoprolol 100mg generic buy metoprolol cheap methylprednisolone generic name

diltiazem for sale online buy diltiazem without a prescription buy allopurinol generic

how to buy diltiazem order generic zyloprim 100mg cheap zyloprim 300mg

buy aristocort 10mg aristocort order order loratadine 10mg for sale

Thanks for your own work on this website. Kate enjoys going through investigation and it is easy to understand why. We know all regarding the compelling form you render very important suggestions by means of this web blog and increase response from some other people on this concern so our girl is always being taught a great deal. Take pleasure in the rest of the new year. You are conducting a terrific job.

aristocort 10mg ca how to get claritin without a prescription order generic claritin

Thank you so much for providing individuals with a very marvellous chance to read in detail from this website. It really is so nice and as well , stuffed with a lot of fun for me personally and my office mates to search your blog at a minimum 3 times every week to study the latest things you have got. And of course, I’m just at all times fascinated for the surprising methods served by you. Some 3 points in this post are honestly the best we have all ever had.

buy rosuvastatin generic buy motilium without prescription domperidone buy online

crestor online buy how to buy zetia domperidone where to buy

Thank you a lot for giving everyone an extraordinarily special chance to read from this website. It really is so brilliant and stuffed with a good time for me personally and my office co-workers to visit your blog minimum three times weekly to read the latest secrets you have got. And indeed, I’m just certainly astounded considering the astounding suggestions you serve. Certain two ideas on this page are rather the most effective I have had.

acillin oral buy cipro 500mg sale metronidazole for sale

tetracycline 250mg usa flexeril online buy buy baclofen for sale

buy ampicillin generic ampicillin 500mg uk metronidazole 400mg tablet

order tetracycline 500mg online cheap buy flexeril 15mg without prescription buy cheap ozobax

trimethoprim cheap buy cleocin 150mg online cheap purchase cleocin sale

buy toradol 10mg generic buy generic toradol inderal 20mg without prescription

septra order online sulfamethoxazole generic buy cleocin paypal

buy toradol pills toradol price inderal oral

buy erythromycin cheap fildena online nolvadex 20mg for sale

plavix 75mg usa purchase plavix pill order coumadin generic

plavix medication clopidogrel 75mg without prescription purchase coumadin

erythromycin brand tamoxifen without prescription where can i buy tamoxifen

buy cheap reglan metoclopramide 20mg pill brand nexium

buy rhinocort generic careprost over the counter bimatoprost for sale

buy reglan esomeprazole 40mg price buy esomeprazole 20mg sale

rhinocort price order rhinocort without prescription buy careprost generic

can i buy cheap finasteride without a prescription

buy topamax 100mg for sale brand levofloxacin 500mg purchase levaquin generic

methocarbamol usa order suhagra 50mg pills sildenafil 100mg cost

cheap topamax 200mg levofloxacin 500mg us buy levaquin pills for sale

purchase methocarbamol sale desyrel 100mg cost buy suhagra

buy avodart cheap buy ranitidine pill buy mobic without a prescription

avodart where to buy buy ranitidine 150mg pills oral mobic 15mg

aurogra 50mg drug cheap sildenafil estradiol oral

sildenafil 100mg price purchase estrace generic buy estrace sale

As I web site possessor I believe the content matter here is rattling great , appreciate it for your hard work. You should keep it up forever! Good Luck.

It’s really a great and helpful piece of info. I’m glad that you shared this useful information with us. Please keep us informed like this. Thanks for sharing.

order celebrex sale buy celebrex 200mg online buy zofran 4mg pills

buy celecoxib 100mg for sale buy generic zofran 8mg order generic ondansetron

What’s up all, here every one is sharing such knowledge, thus it’s nice to read this weblog, and I used to pay a visit this blog daily.

I am extremely inspired together with your writing skills and alsowell as with the layout for your blog. Is this a paid subject or did you customize it yourself? Either way stay up the nice quality writing, it’s rare to peer a nice blog like this one nowadays..

order lamotrigine 50mg sale lamotrigine uk generic minipress 1mg

где купить справку

spironolactone 100mg oral oral aldactone order valacyclovir

lamotrigine 50mg sale generic lamotrigine minipress 1mg cheap

spironolactone tablet simvastatin sale buy valtrex 500mg pills

Very nice article, exactly what I wanted to find.

buy tretinoin gel online avana buy online avana 200mg uk

buy generic finasteride viagra 100mg sale real viagra

order tretinoin online retin cream cost order avana pill

finasteride brand order viagra online cheap purchase viagra sale

Saved as a favorite, I really like your blog!

cheap tadalafil sale viagra online order viagra

buy cheap tadacip buy tadacip 20mg for sale order indocin 50mg

order cialis 10mg online cheap tadalafil online brand viagra 50mg

tadacip without prescription order indocin 75mg without prescription indomethacin 75mg us

cialis brand cheap cialis 10mg ed pills otc

buy cialis pill order tadalafil 40mg male ed drugs

terbinafine 250mg for sale cefixime 100mg drug buy amoxicillin 250mg pills

buy lamisil 250mg pill order suprax without prescription order trimox 500mg for sale

What’s up mates, its great post about tutoringand fully explained, keep it up all the time.

azulfidine 500 mg cost cheap calan 240mg calan 120mg ca

Hi mates, pleasant post and good arguments commented here, I am in fact enjoying by these.

cheap azulfidine 500mg sulfasalazine drug verapamil 120mg generic

buy anastrozole generic clonidine 0.1mg drug clonidine 0.1 mg over the counter

This information is priceless. How can I find out more?

order anastrozole 1 mg generic purchase clarithromycin pills cost catapres 0.1 mg

canadian discount online pharmacy

brand depakote buy divalproex 500mg pills buy generic imdur 40mg

most trusted canadian online pharmacies

https://canadianpharmacieshelp.com/

online pharmacies canada

I must thank you for the efforts you have put in writing this blog. I am hoping to view the same high-grade blog posts from you in the future as well. In fact, your creative writing abilities has motivated me to get my very own website now 😉

prescription drug costs

Hi there, i read your blog occasionally and i own a similar one and i was just wondering if you get a lot of spam feedback? If so how do you reduce it, any plugin or anything you can advise? I get so much lately it’s driving me mad so any help is very much appreciated.

certified canadian online pharmacy

antivert 25 mg tablet buy spiriva generic minocycline 100mg sale

azathioprine 50mg sale azathioprine oral order micardis 80mg sale

antivert 25 mg sale buy spiriva without a prescription minocycline for sale online

buy cheap generic azathioprine micardis order micardis pills

molnunat 200mg without prescription order naprosyn online purchase cefdinir generic

I have been surfing online more than 3 hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my opinion, if all website owners and bloggers made good content as you did, the net will be much more useful than ever before.

buy best erectile dysfunction pills real viagra pills order viagra 50mg generic

oral molnunat order molnunat 200mg sale buy cefdinir pill

buy erectile dysfunction medication viagra 50mg drug buy sildenafil 50mg for sale

prevacid 15mg for sale lansoprazole 30mg cheap cost protonix

lansoprazole for sale online order prevacid for sale protonix 20mg price

I’ve been exploring for a little for any high-quality articles or blog posts in this kind of area . Exploring in Yahoo I at last stumbled upon this site. Reading this info So i’m glad to show that I have a very just right uncanny feeling I came upon exactly what I needed. I so much unquestionably will make certain to don?t overlook this site and give it a look on a constant basis.

where to buy otc ed pills real cialis sites buy cialis 10mg online cheap

pyridium 200 mg brand order amantadine pills order generic amantadine 100 mg

gnc ed pills cialis for sale online buy tadalafil 20mg

Unquestionably believe that which you stated. Your favorite justification appeared to be on the net the simplest thing to be aware of. I say to you, I definitely get irked while people consider worries that they plainly do not know about. You managed to hit the nail upon the top and also defined out the whole thing without having side effect , people can take a signal. Will likely be back to get more. Thanks

phenazopyridine 200mg drug pyridium us purchase amantadine for sale

Have you ever considered about including a little bit more than just your articles? I mean, what you say is fundamental and all. Nevertheless think about if you added some great photos or video clips to give your posts more, “pop”! Your content is excellent but with images and clips, this site could certainly be one of the most beneficial in its niche. Very good blog!

best pills for ed buy tadalafil 5mg online cheap buy tadalafil online cheap

Have you ever thought about publishing an e-book or guest authoring on other sites? I have a blog based upon on the same information you discuss and would really like to have you share some stories/information. I know my visitors would enjoy your work. If you are even remotely interested, feel free to send me an e mail.

buy dapsone medication order aceon 4mg online order perindopril 8mg sale

avlosulfon 100mg without prescription dapsone cost cheap perindopril 8mg

best ed pills non prescription purchase tadalafil online cialis oral

Howdy! This is kind of off topic but I need some help from an established blog. Is it very difficult to set up your own blog? I’m not very techincal but I can figure things out pretty fast. I’m thinking about creating my own but I’m not sure where to start. Do you have any tips or suggestions? Cheers

allegra 120mg cheap order altace 5mg generic order glimepiride 4mg generic

allegra 180mg tablet purchase ramipril online cheap brand amaryl 1mg

Hi there, after reading this remarkable piece of writing i am too glad to share my experience here with friends.

cost hytrin 1mg purchase pioglitazone pills usa cialis sales

etoricoxib 120mg canada oral etoricoxib generic astelin

cost hytrin 1mg buy cheap actos buy cialis 10mg online cheap

etoricoxib generic arcoxia us order azelastine 10ml sale

Bonfire current market price is $0.0000000046 with a 24 hour trading volume of $116. The total available supply of Bonfire is 0 BONFIRE with a maximum supply of 1,000.00T BONFIRE. It has secured Rank (Not Available) in the cryptocurrency market with a marketcap of $0. The BONFIRE price is 0.75% up in the last 24 hours. Launched in April 2021 as a “frictionless and yield-generating” contract, it didn’t take long for Bonfire to see its first bull run and a massive price increase. Every minute we trace the exchange rate. The Bonfire rose by 0.0000 BZD in the last minute. The site shows a table for posting 10 minutes of the Bonfire to the Belize dollar for each minute. Convenient posting of information at the minute rate on the site. Bonfire is a recent example of a cryptocurrency that had early success and then fell off a cliff. More such tokens pop up all the time, with EthereumMax and Baby Doge Coin being two recent examples. It’s important to recognize tokens like these so that you don’t waste your money on a bad investment. Trending Coins and Tokens Anything can happen in the digital finance world, so we suggest analyzing from your end once; if you are ready to check your luck, then go for it. What are Bonfire Trading Platforms? It is believed globally that cryptocurrency is going to change the world.

http://smilejobs.mireene.co.kr/bbs/board.php?bo_table=free&wr_id=141

The certification, assessments and hackerone involvement that Crypto have, show that they are serious about security, demonstrating that they are a company that want to earn trust from their users, as well as 3rd parties, so they can provide additional functionality. Other companies (such as Binance) have really struggled with regulatory policy and have had to withdraw services from Europe because of this. This article will outline how to sell tokens on Crypto from your desktop and iOS or Android app. We’ll also cover the app’s wallet options and how to transfer the funds to your bank account. We provided fast, secure, and professional crypto trading services Please enable JavaScript Many crypto wallets have built-in crypto exchanges, and some even allow you to exchange your crypto for cash directly. While crypto wallets are designed to store and secure your crypto, many of them partner with crypto exchanges to offer trading services.

I am extremely inspired with your writing skills and alsosmartly as with the format for your blog. Is this a paid topic or did you customize it yourself? Either way stay up the nice quality writing, it’s rare to peer a nice blog like this one these days..

online pharmacy without precriptions

https://canadianpharmaciesturbo.com/

online pharmacies canada

generic irbesartan 300mg buy avapro cheap buy buspar paypal

cordarone 200mg without prescription buy amiodarone 200mg phenytoin 100 mg sale

buy irbesartan cheap buy temovate cream for sale buspar brand

order amiodarone 200mg pill order amiodarone 200mg online cheap buy dilantin generic

Every weekend i used to go to see this web site, as i want enjoyment, since this this website conations actually pleasant funny data too.

order albenza 400mg sale brand medroxyprogesterone 10mg medroxyprogesterone usa

Hi friends, its wonderful post about teachingand fully explained, keep it up all the time.

where can i buy albenza provera online buy provera 10mg without prescription

oxybutynin where to buy alendronate 70mg cost order alendronate pill

It is appropriate time to make some plans for the future and it is time to be happy. I have read this post and if I could I want to suggest you few interesting things or advice. Perhaps you could write next articles referring to this article. I want to read more things about it!

hey there and thank you for your information I’ve definitely picked up anything new from right here. I did however expertise some technical issues using this site, since I experienced to reload the web site a lot of times previous to I could get it to load properly. I had been wondering if your hosting is OK? Not that I am complaining, but sluggish loading instances times will very frequently affect your placement in google and can damage your high quality score if advertising and marketing with Adwords. Anyway I’m adding this RSS to my e-mail and can look out for a lot more of your respective fascinating content. Make sure you update this again soon.

order ditropan pill buy oxybutynin pills for sale buy alendronate 70mg generic

praziquantel 600mg usa buy periactin tablets buy periactin online

Very good website you have here but I was curious about if you knew of any message boards that cover the same topics talked about in this article? I’d really love to be a part of group where I can get comments from other knowledgeable individuals that share the same interest. If you have any recommendations, please let me know. Cheers!

order praziquantel without prescription hydrochlorothiazide 25 mg sale purchase cyproheptadine pills

order furadantin 100 mg pill buy ibuprofen pills for sale purchase pamelor generic

luvox price purchase duloxetine online buy cymbalta 20mg online

Hi there, yeah this post is really good and I have learned lot of things from it concerning blogging. thanks.

order macrodantin generic oral nortriptyline 25 mg buy nortriptyline 25mg generic

buy generic luvox oral fluvoxamine 100mg order duloxetine 40mg generic

I do accept as true with all the ideas you have presented on your post. They are very convincing and will definitely work. Still, the posts are too quick for newbies. May you please extend them a bit from next time? Thank you for the post.

buy paracetamol 500mg pills buy pepcid paypal order famotidine 40mg generic

glucotrol 10mg for sale where can i buy glucotrol how to get betamethasone without a prescription

Can I just say what a relief to find someone who really knows what they’re talking about online. You definitely understand how to bring an issue to light and make it important. More and more people must read this and understand this side of the story. I can’t believe you aren’t more popular since you surely have the gift.

how to get glipizide without a prescription buy glucotrol without a prescription brand betnovate

Excellent blog you have here.. It’s hard to find high-quality writing like yours these days. I seriously appreciate people like you! Take care!!

purchase panadol online cheap pepcid us cheap pepcid 40mg

clomipramine over the counter buy progesterone 100mg without prescription generic prometrium 200mg

This website is known as a walk-by means of for the entire data you wished about this and didn’t know who to ask. Glimpse right here, and also you’ll positively uncover it.

anafranil 50mg us itraconazole 100 mg brand progesterone 100mg sale

Thank you for any other fantastic article. Where else may just anyone get that kind of information in such a perfect approach of writing? I have a presentation next week, and I am at the look for such information.

tacrolimus 1mg tablet ropinirole without prescription buy requip online

tindamax pills order zyprexa purchase bystolic online

prograf pills mirtazapine buy online buy ropinirole 2mg without prescription

order tindamax without prescription buy olanzapine 10mg generic bystolic 5mg brand

rocaltrol 0.25mg sale cost rocaltrol buy generic tricor online

brand diovan clozaril buy online buy ipratropium tablets

cheap valsartan combivent 100mcg canada buy ipratropium generic

Hurrah! At last I got a website from where I can in fact take helpful data regarding my study and knowledge.

decadron 0,5 mg over the counter nateglinide tablet buy cheap generic nateglinide

order oxcarbazepine 600mg buy uroxatral online generic urso 300mg

Magnificent goods from you, man. I’ve understand your stuff previous to and you’re just too magnificent. I really like what you’ve acquired here, really like what you’re stating and the way in which you say it. You make it entertaining and you still take care of to keep it smart. I cant wait to read far more from you. This is actually a wonderful site.

order oxcarbazepine 300mg buy uroxatral 10 mg pills buy urso 150mg sale

decadron 0,5 mg brand linezolid 600mg ca nateglinide price

When someone writes an article he/she maintains the plan of a user in his/her mind that how a user can know it. So that’s why this post is great. Thanks!

bupropion 150 mg ca order zyban pills order strattera 10mg sale

My brother suggested I might like this website. He was totally right. This post actually made my day. You cann’t imagine just how much time I had spent for this information! Thanks!

captopril 25 mg pill captopril 25 mg brand cost carbamazepine 400mg

I am curious to find out what blog system you have been utilizing? I’m experiencing some minor security problems with my latest website and I would like to find something more safeguarded. Do you have any solutions?

Have you ever considered about including a little bit more than just your articles? I mean, what you say is valuable and all. However think about if you added some great graphics or video clips to give your posts more, “pop”! Your content is excellent but with images and clips, this website could certainly be one of the greatest in its niche. Good blog!

capoten us order atacand 16mg without prescription order tegretol pills

zyban online where can i buy strattera atomoxetine brand

Howdy would you mind stating which blog platform you’re working with? I’m looking to start my own blog in the near future but I’m having a tough time choosing between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design seems different then most blogs and I’m looking for something completely unique. P.S My apologies for getting off-topic but I had to ask!

buy ciplox 500 mg cefadroxil price purchase cefadroxil pill

Hi there to all, the contents present at this website are truly awesome for people experience, well, keep up the nice work fellows.

buy seroquel generic buy zoloft generic buy lexapro 10mg generic

We are a group of volunteers and starting a new scheme in our community. Your site provided us with valuable information to work on. You have done an impressive job and our whole community will be grateful to you.

order ciprofloxacin online order ciplox generic generic duricef

where to buy quetiapine without a prescription order sertraline generic escitalopram 20mg cost

dating singles site: free dating sites online – top online sites

buy prednisone online australia: http://prednisone1st.store/# prednisone 20 mg tablet

buy epivir without a prescription buy accupril 10 mg generic order accupril 10mg for sale

epivir medication purchase zidovudine generic buy accupril 10 mg without prescription

Hello there! Would you mind if I share your blog with my twitter group? There’s a lot of people that I think would really enjoy your content. Please let me know. Cheers

Thanks for finally writing about > %blog_title% < Liked it!

oral fluoxetine 40mg order generic naltrexone 50mg purchase femara

amoxicillin price without insurance: amoxicillin 500 mg without a prescription buy amoxicillin 500mg

https://cheapestedpills.com/# gnc ed pills

https://pharmacyreview.best/# canadian pharmacy meds review

amoxicillin 500mg capsule buy amoxicillin – amoxicillin 500mg capsules price

best rated canadian pharmacy prescription drugs canada buy online

best erection pills: cheap erectile dysfunction pill – ed medications

What side effects can this medication cause?

amoxicillin 500mg capsule buy online amoxicillin 500mg price in canada – buy cheap amoxicillin

Generic Name.

frumil order buy clindamycin gel purchase zovirax for sale

buying generic propecia no prescription get propecia without dr prescription

I loved your article post.

I relish, cause I found exactly what I used to be taking a look for. You have ended my 4 day long hunt! God Bless you man. Have a nice day. Bye

compare ed drugs: drugs for ed – ed pills that really work

frumil price where can i buy adapen buy acyclovir cheap

where to get amoxicillin over the counter: amoxicillin capsule 500mg price can you buy amoxicillin over the counter

https://propecia1st.science/# get propecia online

my canadian pharmacy review canadian pharmacy 1 internet online drugstore

buy amoxicillin 500mg usa amoxicillin discount coupon – cost of amoxicillin prescription

bisoprolol 5mg without prescription buy myambutol 1000mg pills order terramycin for sale

Hi everyone, it’s my first go to see at this web site, and piece of writing is in fact fruitful in favor of me, keep up posting such posts.

pharmacy rx world canada canada pharmacy world

how to get cheap mobic without dr prescription: can i get cheap mobic no prescription – get generic mobic pill

zebeta 5mg pill oxytetracycline canada oxytetracycline without prescription

buy amoxil: http://amoxicillins.com/# cheap amoxicillin 500mg

buy generic valaciclovir over the counter valcivir medication buy floxin 200mg sale

can i purchase generic mobic without dr prescription can i buy generic mobic online can i order cheap mobic online

indian pharmacy paypal: mail order pharmacy india – indianpharmacy com

http://indiamedicine.world/# indian pharmacy online

order valcivir 500mg generic order famvir pills ofloxacin price

mexican pharmaceuticals online mexico drug stores pharmacies or purple pharmacy mexico price list

http://ww35.youtubeconveter.com/__media__/js/netsoltrademark.php?d=mexpharmacy.sbs mexican rx online

reputable mexican pharmacies online reputable mexican pharmacies online and medication from mexico pharmacy mexico pharmacies prescription drugs

Online medicine home delivery: online pharmacy india – indian pharmacy

buy drugs from canada canadian discount pharmacy or is canadian pharmacy legit

http://cardiotheater.tv/__media__/js/netsoltrademark.php?d=certifiedcanadapharm.store buying from canadian pharmacies

canadian family pharmacy onlinepharmaciescanada com and canada ed drugs canada pharmacy online

Attractive section of content. I just stumbled upon your web site and in accession capital to claim that I get in fact loved account your weblog posts. Any way I will be subscribing on your feeds and even I achievement you get entry to persistently fast.

vantin 200mg over the counter theo-24 Cr 400 mg ca flixotide online buy

https://mexpharmacy.sbs/# buying prescription drugs in mexico online

Pretty! This was a really wonderful post. Thank you for providing this information.

pharmacy in canada: pharmacy canadian – safe canadian pharmacy

Hello there, just became aware of your blog through Google, and found that it is really informative. I’m gonna watch out for brussels. I will appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

keppra cost bactrim pills order generic sildenafil 100mg

purchase vantin without prescription purchase vantin for sale purchase flixotide nasal spray

http://mexpharmacy.sbs/# mexico pharmacies prescription drugs

Looking forward to reading more. Great post.Thanks Again. Fantastic.

Thanks for your write-up on the travel industry. I will also like to include that if you are one senior thinking about traveling, it’s absolutely crucial that you buy travel insurance for older persons. When traveling, elderly people are at biggest risk being in need of a healthcare emergency. Obtaining the right insurance coverage package for the age group can look after your health and provide you with peace of mind.

You must participate in a contest for the most effective blogs on the web. I will recommend this site!

Недорогой мужской эромассаж Москва выбрать лучший

mexican pharmaceuticals online reputable mexican pharmacies online or mexico pharmacies prescription drugs

http://www.google.co.cr/url?q=https://mexpharmacy.sbs purple pharmacy mexico price list

best online pharmacies in mexico mexico pharmacies prescription drugs and buying prescription drugs in mexico online medicine in mexico pharmacies

levetiracetam 1000mg canada buy levetiracetam generic order viagra for sale

Do you have a spam problem on this blog; I also am a blogger, and I was wanting to know your situation; many of us have created some nice practices and we are looking to exchange strategies with other folks, why not shoot me an e-mail if interested.

Howdy would you mind letting me know which webhost you’re using? I’ve loaded your blog in 3 completely different browsers and I must say this blog loads a lot faster then most. Can you suggest a good web hosting provider at a honest price? Kudos, I appreciate it!

Appreciate you sharing, great article post.Really looking forward to read more. Fantastic.

buying from online mexican pharmacy: buying from online mexican pharmacy – mexican online pharmacies prescription drugs

canadian pharmacies online canada drug pharmacy or best online canadian pharmacy

http://michelsenterprises.com/__media__/js/netsoltrademark.php?d=certifiedcanadapharm.store canadian drug stores

pharmacy canadian pharmacy in canada and canadian drugstore online canadian pharmacy 24h com safe

https://indiamedicine.world/# indian pharmacies safe

What’s up, constantly i used to check website posts here early in the morning, since i like to gain knowledge of more and more.

Great post. I used to be checking continuously this weblog and I am impressed! Very useful information specifically the remaining part 🙂 I deal with such information a lot. I was seeking this certain information for a long time. Thanks and best of luck.

indian pharmacies safe: best online pharmacy india – indian pharmacies safe

https://certifiedcanadapharm.store/# canadian drug pharmacy

Valuable info. Lucky me I found your web site by accident, and I’m shocked why this accident did not happened earlier! I bookmarked it.

I cannot thank you enough for the blog.Thanks Again.

Do you have a spam problem on this blog; I also am a blogger, and I was wanting to know your situation; we have developed some nice practices and we are looking to trade solutions with others, why not shoot me an e-mail if interested.

reputable mexican pharmacies online mexican border pharmacies shipping to usa or purple pharmacy mexico price list

http://double-down-band.com/__media__/js/netsoltrademark.php?d=mexpharmacy.sbs mexican online pharmacies prescription drugs

mexican pharmaceuticals online п»їbest mexican online pharmacies and mexican pharmaceuticals online mexican mail order pharmacies

hey there and thanks to your information ? I?ve certainly picked up anything new from proper here. I did however experience several technical points the use of this website, since I skilled to reload the website a lot of occasions prior to I may get it to load correctly. I have been brooding about in case your web hosting is OK? Now not that I’m complaining, however sluggish loading circumstances times will very frequently affect your placement in google and can damage your quality rating if advertising and ***********|advertising|advertising|advertising and *********** with Adwords. Well I?m adding this RSS to my e-mail and could glance out for much more of your respective fascinating content. Ensure that you replace this once more very soon..

Im grateful for the blog article. Will read on…

https://indiamedicine.world/# indian pharmacy

canadian pharmacy meds: canadian pharmacy 365 – legitimate canadian pharmacy online

canadian pharmacy 24h com canadian pharmacy ltd or legitimate canadian pharmacy online

http://ww4.hiphotels.net/__media__/js/netsoltrademark.php?d=certifiedcanadapharm.store canadian mail order pharmacy

legit canadian pharmacy best canadian pharmacy online and canadian family pharmacy canada pharmacy reviews

I truly appreciate this article.Really thank you! Great.

order zaditor 1mg for sale buy doxepin pills for sale order imipramine online cheap

cialis without prescription buy generic viagra 100mg buy sildenafil sale

Thanks a bunch for sharing this with all of us you actually realize what you are speaking approximately! Bookmarked. Please also talk over with my website =). We could have a hyperlink trade contract among us!

Heya this is kinda of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding expertise so I wanted to get advice from someone with experience. Any help would be greatly appreciated!

https://certifiedcanadapharm.store/# canadian drug pharmacy

I loved as much as you’ll receive carried out right here. The sketch is attractive, your authored material stylish. nonetheless, you command get got an shakiness over that you wish be delivering the following. unwell unquestionably come more formerly again as exactly the same nearly very often inside case you shield this increase.

india online pharmacy: best online pharmacy india – indianpharmacy com

order ketotifen 1mg online cheap buy ziprasidone generic buy tofranil 75mg online cheap

https://gabapentin.pro/# neurontin 100mg tablet

brand cialis pills order generic sildenafil 50mg viagra 100 mg

Thanks for your publication. I also believe laptop computers have become more and more popular currently, and now in many cases are the only type of computer utilized in a household. The reason is that at the same time potentially they are becoming more and more very affordable, their computing power keeps growing to the point where they are as potent as personal computers coming from just a few years ago.

ivermectin 80 mg ivermectin tablets uk or ivermectin 3mg

http://patricekatz.com/__media__/js/netsoltrademark.php?d=stromectolonline.pro buy ivermectin uk

ivermectin humans ivermectin 4 tablets price and ivermectin cost ivermectin 3 mg tabs

2000 mg neurontin: neurontin 300 mg caps – neurontin 100mg

It is my belief that mesothelioma can be the most lethal cancer. It’s got unusual traits. The more I look at it the harder I am confident it does not work like a true solid flesh cancer. In the event mesothelioma is really a rogue virus-like infection, then there is the prospects for developing a vaccine and offering vaccination to asbestos subjected people who are at high risk involving developing foreseeable future asbestos related malignancies. Thanks for giving your ideas for this important health issue.

Please let me know if you’re looking for a author for your weblog. You have some really great posts and I think I would be a good asset. If you ever want to take some of the load off, I’d really like to write some material for your blog in exchange for a link back to mine. Please blast me an e-mail if interested. Many thanks!

https://azithromycin.men/# zithromax tablets

I got this website from my pal who informed me about this site and now this time I am visiting this site and reading very informative articles here.

neurontin capsules 300mg neurontin 100mg cap or generic gabapentin

http://personalslotmachine.com/__media__/js/netsoltrademark.php?d=gabapentin.pro neurontin 400mg

neurontin 200 mg capsules neurontin prescription coupon and neurontin pills neurontin 50mg cost

ivermectin usa price: ivermectin 6 – ivermectin price comparison

https://azithromycin.men/# purchase zithromax z-pak

One thing I’d prefer to say is car insurance canceling is a hated experience and if you’re doing the suitable things as being a driver you simply won’t get one. A lot of people do are sent the notice that they have been officially dumped by their insurance company and many have to struggle to get further insurance following a cancellation. Affordable auto insurance rates tend to be hard to get after a cancellation. Knowing the main reasons regarding auto insurance termination can help individuals prevent getting rid of in one of the most crucial privileges out there. Thanks for the strategies shared by your blog.

Thanks so much for the article post.Really looking forward to read more. Keep writing.

I enjoy what you guys are up too. This type of clever work and exposure! Keep up the awesome works guys I’ve incorporated you guys to my blogroll.

I don’t know if it’s just me or if everyone else experiencing problems with your website. It appears as if some of the text on your posts are running off the screen. Can someone else please comment and let me know if this is happening to them too? This could be a problem with my web browser because I’ve had this happen before. Thanks

buy minoxidil without prescription tamsulosin pills the blue pill ed

Thanks for the marvelous posting! I quite enjoyed reading it, you’re a great author.I will be sure to bookmark your blog and will eventually come back someday. I want to encourage one to continue your great posts, have a nice holiday weekend!

buy acarbose 25mg generic precose 50mg us order fulvicin 250mg sale

neurontin 4000 mg: neurontin cost generic – neurontin prescription coupon

ivermectin cost canada ivermectin 4000 mcg or ivermectin price usa

http://youalonearerealtome.com/__media__/js/netsoltrademark.php?d=stromectolonline.pro ivermectin usa price

buy ivermectin pills ivermectin cost uk and cost of ivermectin medicine cost of ivermectin lotion

mintop over the counter buy mintop for sale cheap erectile dysfunction

order acarbose online generic prandin 1mg buy fulvicin pills

http://azithromycin.men/# how to get zithromax

http://paxlovid.top/# paxlovid pill

I?m not sure where you’re getting your info, but good topic. I needs to spend some time learning much more or understanding more. Thanks for excellent information I was looking for this info for my mission.

antibiotic without presription: buy antibiotics for uti – get antibiotics quickly

natural ed medications best pills for ed or treatment for ed

http://callidussoftware.biz/__media__/js/netsoltrademark.php?d=ed-pills.men ed pills comparison

cheap erectile dysfunction pills online new ed treatments and cure ed non prescription erection pills

WOW just what I was searching for. Came here by searching for %keyword%

After research a couple of of the weblog posts in your website now, and I really like your manner of blogging. I bookmarked it to my bookmark web site checklist and can be checking back soon. Pls take a look at my web page as well and let me know what you think.

lisinopril 2 5 mg tablets: prinivil 2.5 mg – prinivil 20mg tabs

http://misoprostol.guru/# buy cytotec over the counter

lipitor 40 mg tablet lipitor 40 mg price lipitor prescription prices

Thanks for the new things you have disclosed in your blog post. One thing I would like to comment on is that FSBO human relationships are built eventually. By launching yourself to owners the first weekend their FSBO is actually announced, before the masses commence calling on Monday, you develop a good link. By sending them resources, educational supplies, free reviews, and forms, you become an ally. By subtracting a personal desire for them plus their problem, you develop a solid connection that, many times, pays off once the owners opt with a broker they know and also trust – preferably you.

Just a smiling visitant here to share the love (:, btw outstanding design and style.

aspirin for sale online imiquimod canada order zovirax online

https://lisinopril.pro/# buy 40 mg lisinopril

That is very attention-grabbing, You are an overly professional blogger. I’ve joined your rss feed and stay up for looking for extra of your great post. Also, I have shared your web site in my social networks!

cipro pharmacy buy ciprofloxacin or cipro 500mg best prices

http://nbtexasconventioncenter.org/__media__/js/netsoltrademark.php?d=ciprofloxacin.ink ciprofloxacin over the counter

ciprofloxacin ciprofloxacin generic price and buy generic ciprofloxacin buy cipro online without prescription

buy cytotec: cytotec pills buy online – п»їcytotec pills online

https://misoprostol.guru/# buy cytotec in usa

order cytotec online order cytotec online cytotec pills buy online

Way cool! Some very valid points! I appreciate you writing this article and the rest of the site is also really good.

Hi there, I found your web site via Google while looking for a related topic, your web site came up, it looks good. I have bookmarked it in my google bookmarks.

https://misoprostol.guru/# Abortion pills online

I haven?t checked in here for some time as I thought it was getting boring, but the last few posts are good quality so I guess I will add you back to my everyday bloglist. You deserve it my friend 🙂

Thanks for your post on the traveling industry. I’d also like to include that if you’re a senior thinking about traveling, it truly is absolutely important to buy traveling insurance for retirees. When traveling, seniors are at biggest risk being in need of a health care emergency. Receiving the right insurance policies package for the age group can protect your health and provide peace of mind.

aspirin cheap aspirin price buy imiquad online

cipro 500mg best prices: buy cipro online usa – ciprofloxacin generic

https://misoprostol.guru/# buy cytotec pills online cheap

can i get cheap avodart price buy cheap avodart generic avodart no prescription

buy cytotec Cytotec 200mcg price or buy cytotec pills

http://euthayan.com/__media__/js/netsoltrademark.php?d=misoprostol.guru order cytotec online

п»їcytotec pills online buy misoprostol over the counter and buy cytotec order cytotec online

http://avodart.pro/# how to buy avodart without insurance

whoah this blog is magnificent i love reading your posts. Keep up the good work! You know, a lot of people are hunting around for this info, you can aid them greatly.

cost dipyridamole 25mg order pravachol 20mg online buy cheap pravastatin

cheap dipyridamole 100mg brand gemfibrozil 300 mg pravachol 10mg canada

There may be noticeably a bundle to learn about this. I assume you made certain good factors in features also.

https://lisinopril.pro/# lisinopril 15 mg

wow, awesome article post.Really looking forward to read more. Really Cool.

Great post here. One thing I would really like to say is most professional areas consider the Bachelor Degree like thejust like the entry level standard for an online diploma. When Associate College diplomas are a great way to begin, completing the Bachelors opens many doors to various employment opportunities, there are numerous online Bachelor Course Programs available by institutions like The University of Phoenix, Intercontinental University Online and Kaplan. Another issue is that many brick and mortar institutions offer Online versions of their qualifications but usually for a greatly higher amount of money than the firms that specialize in online higher education degree programs.

https://avodart.pro/# where to buy generic avodart without dr prescription

melatonin 3mg canada purchase norethindrone online purchase danazol

Its like you read my mind! You seem to know so much about this, like you wrote the book in it or something. I think that you could do with some pics to drive the message home a bit, but other than that, this is great blog. An excellent read. I’ll definitely be back.

melatonin 3mg price buy norethindrone cheap danazol 100 mg drug

order cytotec online order cytotec online or buy cytotec pills

http://packerlandtransport.com/__media__/js/netsoltrademark.php?d=misoprostol.guru" cytotec buy online usa

purchase cytotec buy cytotec and cytotec abortion pill cytotec abortion pill

https://lipitor.pro/# lipitor 40 mg cost

My brother suggested I may like this blog. He used to be totally right. This post actually made my day. You cann’t imagine just how much time I had spent for this information! Thank you!

advertorialpromovare.ro

hey there and thank you for your info ? I have certainly picked up something new from right here. I did however expertise a few technical issues using this website, since I experienced to reload the site many times previous to I could get it to load correctly. I had been wondering if your web host is OK? Not that I am complaining, but sluggish loading instances times will often affect your placement in google and could damage your high-quality score if ads and marketing with Adwords. Anyway I?m adding this RSS to my e-mail and could look out for a lot more of your respective exciting content. Ensure that you update this again very soon..

My partner and I absolutely love your blog and find many of your post’s to be just what I’m looking for. Does one offer guest writers to write content for yourself? I wouldn’t mind composing a post or elaborating on most of the subjects you write with regards to here. Again, awesome site!

Online medicine home delivery top 10 online pharmacy in india india online pharmacy

mexican pharmaceuticals online medication from mexico pharmacy or medicine in mexico pharmacies

http://bafflementrooms.com/__media__/js/netsoltrademark.php?d=mexicanpharmacy.guru buying prescription drugs in mexico

mexico pharmacies prescription drugs mexican drugstore online and purple pharmacy mexico price list reputable mexican pharmacies online

Great ? I should certainly pronounce, impressed with your website. I had no trouble navigating through all tabs and related info ended up being truly easy to do to access. I recently found what I hoped for before you know it in the least. Quite unusual. Is likely to appreciate it for those who add forums or anything, site theme . a tones way for your client to communicate. Excellent task..

cazare cu ponton

https://certifiedcanadapills.pro/# canada rx pharmacy world

With havin so much written content do you ever run into any issues of plagorism or copyright infringement? My website has a lot of completely unique content I’ve either created myself or outsourced but it looks like a lot of it is popping it up all over the web without my authorization. Do you know any methods to help prevent content from being ripped off? I’d really appreciate it.

reputable indian pharmacies indian pharmacy or top 10 online pharmacy in india

http://hairtransplantconsumer.com/__media__/js/netsoltrademark.php?d=indiapharmacy.cheap top 10 online pharmacy in india

top online pharmacy india Online medicine order and best online pharmacy india indianpharmacy com

http://indiapharmacy.cheap/# mail order pharmacy india

Thanks for your article. Another item is that being photographer entails not only problems in taking award-winning photographs but additionally hardships in getting the best camera suited to your needs and most especially issues in maintaining the standard of your camera. This can be very genuine and noticeable for those photography enthusiasts that are straight into capturing the nature’s interesting scenes — the mountains, the actual forests, the actual wild or the seas. Going to these daring places undoubtedly requires a dslr camera that can live up to the wild’s unpleasant areas.

pharmacy wholesalers canada canadian pharmacy online best canadian pharmacy to order from

order duphaston 10mg online cheap order forxiga 10 mg order generic empagliflozin 10mg

Разрешение на строительство — это официальный письменное удостоверение, выдаваемый официальными органами государственной власти или субъектного самоуправления, который дает возможность начать строительную деятельность или осуществление строительных операций.

Разрешение на строительство на существующий объект утверждает нормативные принципы и регламенты к строительной деятельности, включая разрешенные виды работ, дозволенные материалы и техники, а также включает строительные нормативные акты и пакеты охраны. Получение разрешения на строительные операции является обязательным документов для строительной сферы.

lacul murighiol

how to buy duphaston empagliflozin 10mg drug buy jardiance no prescription

buy florinef 100mcg generic buy generic bisacodyl purchase loperamide

male erection pills non prescription ed drugs or buy ed pills online

http://specialdoc.com/__media__/js/netsoltrademark.php?d=edpill.men medication for ed dysfunction

generic ed drugs the best ed pill and best ed medication cheap erectile dysfunction

fludrocortisone price cheap bisacodyl 5mg loperamide pills

Can I just say what a relief to find somebody that actually knows what they’re talking about on the web. You certainly understand how to bring an issue to light and make it important. More and more people must read this and understand this side of the story. It’s surprising you’re not more popular since you surely have the gift.

This piece of writing is in fact a pleasant one it helps new net viewers, who are wishing for blogging.

I?d should examine with you here. Which is not one thing I usually do! I take pleasure in reading a submit that will make folks think. Also, thanks for permitting me to remark!

excellent points altogether, you simply received a brand new reader. What could you recommend about your submit that you simply made a few days in the past? Any sure?

buy kamagra online kamagra or order kamagra oral jelly

http://s-guarddirect.com/__media__/js/netsoltrademark.php?d=kamagra.men kamagra

kamagra buy kamagra online and cheap kamagra buy kamagra online

Thanks for the concepts you share through your blog. In addition, several young women exactly who become pregnant tend not to even aim to get health care insurance because they are full of fearfulness they might not qualify. Although a few states at this point require that insurers supply coverage regardless of pre-existing conditions. Prices on these guaranteed programs are usually bigger, but when thinking about the high cost of medical care bills it may be some sort of a safer route to take to protect your own financial future.

It’s nice to see the best quality content from such sites.

cures for ed best ed pills non prescription or ed pills otc

http://credit411.net/__media__/js/netsoltrademark.php?d=edpill.men mens erection pills

erection pills medicine erectile dysfunction and the best ed pills mens erection pills

prasugrel 10 mg canada buy thorazine 100mg sale detrol uk

I really liked your post. Awesome.

I’ve been absent for some time, but now I remember why I used to love this site. Thank you, I?ll try and check back more often. How frequently you update your web site?

monograph cost order monograph 600 mg generic oral cilostazol 100mg