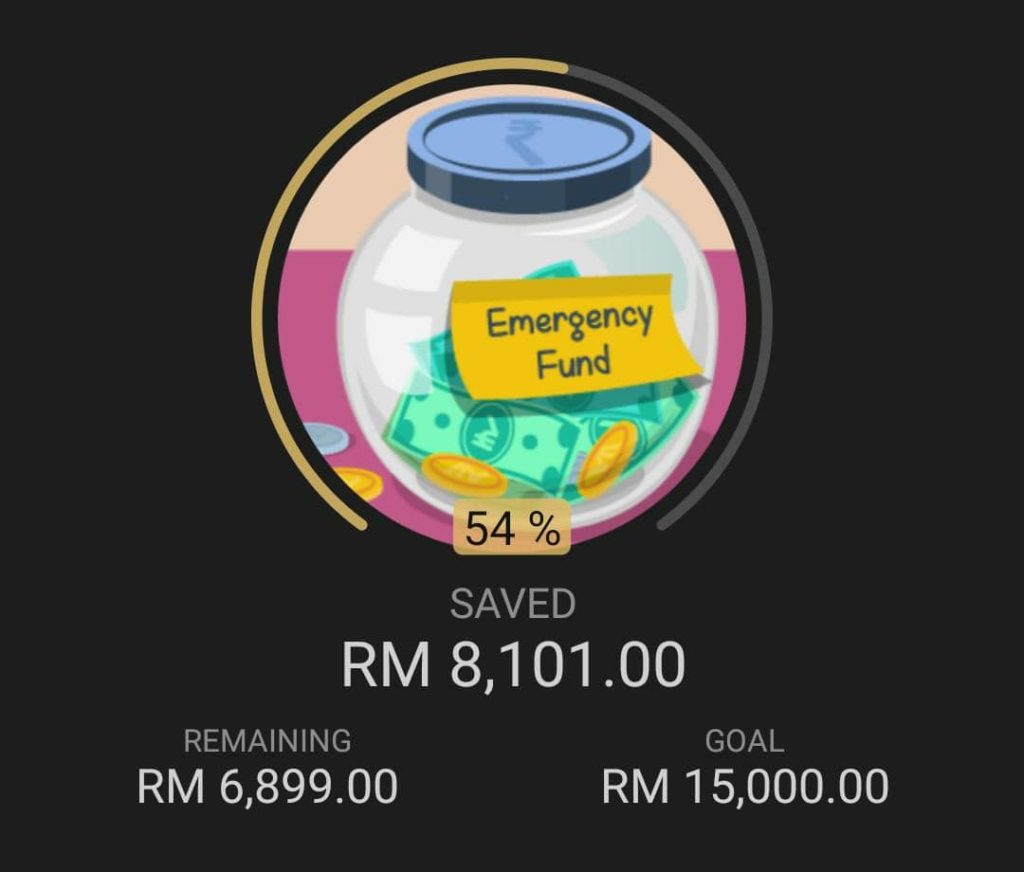

Since I’ve announced to the entire world that I aim to save my first RM15k as an emergency fund, let me be transparent all the way lah regarding the current status of my emergency fund goal. And here’s my first update, tadaaaa~

RM8k say whaaat? Yeay!! To see that I’ve managed to put aside RM8,101.00 in 4 months, haaa it feels surreal! Because I still remember few months back thinking that there’s no way I could ever save such amount of money. Heck, I even feel impossible now to save the balance RM6,899.00. But the figure speaks for itself, I did it! And I will do it more.

[Update: Yes I did more! The Day I Saved My First RM10,000]

If there’s anyone like me here who’s just starting out and feels the way I feel now, hang in there. We can do this. I would love to share the practical ways that have worked for me so far, and also some ways that I’ve tried but just didn’t work.

Ways to save money that work for me

1. The cliche but oh-so-true pay yourself first

Before this, everytime I read a financial article recommending me to pay myself first, I’d sigh “Ahh not this one again“. But it’s true though. Very true. So now as cliche as it sounds, once I get my salary, I’ll put aside a portion of money for emergency fund the same way I allocate money for other expenses.

I admit it’s easier said than done. My initial efforts to apply this failed miserably because I tend to use or take out the money halfway for some hanky panky purposes. What started as a hopeful month tumbled into a downward spiral of self frustration and regret.

Now I think I’ve figured it out. Here’s the methods that I adopt to stop myself from touching those savings.

- First, have a proper budget plan so you know what your expenses throughout the month are.

- Secondly, be realistic with the amount that you want to save. So as not to discourage myself month after month, I no longer set aside a huge sum too early in the month. I only save a portion that I think is reasonable so I can stick to it.

- Thirdly and finally, don’t forget to set aside some fun money too so you’re not inclined to touch your savings.

It’s not easy, but it’s possible. Trust me.

2. 52-week savings challenge

So I made a list of the amount of money to save every week for 2020; the lowest sum being RM2 which keeps increasing by RM2 every week until it comes up to RM104 by the 52nd week. Instead of following the standard challenge to save by week in sequence, I save according to my means on that particular week. For example, if I have extra money this week, I’d save more. If I spend too much, perhaps for any activity of the week, I’d save less.

It has personally became a fun weekly routine for me. This challenge works great in combination with my methods of paying myself first because this way, I’m being realistic with my expenses and savings. I can constantly assess my money state and save some. No more self disappointment in the middle of the month. Instead, dopamine gets released each time I highlight the weekly sum saved. Win win.

3. No buy challenge

If there’s one way that really skyrockets my savings progress – it’s my no buy year journey. Like seriously. It cuts a lot of unnecessary expenses and most importantly, I no longer dig into my savings just to shop.

Please give no buy challenge a try. Perhaps you can’t commit for a whole year, so try it for a month. Or a week. Whatever works for you. I promise you can see the difference, especially if you’re a shopaholic. Extra money every month, who don’t want that? Ka-ching!

4. Put aside work claims and bonuses

If your line of work involves travelling, outstation or site work, pretty sure you’ll have weekly or monthly work claims. This is a precious way to save money for me – I don’t touch my claims money (started this year lah, all this while I spent kaw kaw)!

Most times, I would get repaid more than my actual expenses due to a higher milleage rate and allowance for interstate business trips. Usually, around RM150+ per month and during the good times (which are also tiring because that means I travel more), I can get up to RM700+. All into savings!

Well as for bonus, it is a bonus. Especially if you manage to get one this year, be super grateful – money falling from sky! It’s nice to get ourselves gifts and treat others with it but don’t forget to save some for rainy days.

Ways to save money that don’t work for me

1. Save the green notes

It’s simple, put aside RM5 everytime you get it. I did this before but I don’t fancy it. Granted, I did get to save money. In fact, I managed to use the RM5 saved last year (in total around RM500 over a year or less) as duit raya and raya related expenses.

But oh man, the headache and the mini anxiety I got every time I was on cash transactions with the cashiers. Please don’t give me five ringgit, please no five ringgit. That’s the internal prayer I had throughout the year. Not fun! So I’m ditching this for good.

But perhaps, this may work for you. Depends. Also, it’s not just RM5. It can be RM1 or RM10 or RM20 or even coins, no problem.

2. Daily saving challenge

Same as above, too much headache. I had to think about it every day, some days I missed which caused distress. Some days especially near salary time, I just couldn’t save. Naturally after awhile, I gave up. Hard to keep track every day, I prefer the weekly saving challenge.

The bottom line is…

Find what works (and what don’t) for you. There are so many practical ways and tips out there, we just have to find out what works for us. Personally, I realised that I don’t like any rigid and tedious plans to save money. I don’t want to think about it every single day. So I apply what works for me which mostly don’t feel much like a chore.

Here are some articles on ways and tips to save money:

- 7-step plan to building an emergency fund, even if you’re starting from scratch – Business Insider Malaysia

- 50 Ways to Save Money in Malaysia, From Easy to Impossible – Ringgit Oh Ringgit

- 8 Creative Ways for Malaysians to Save Money in 2019 – gobear

- Fun Ways to Save Money – RinggitPlus

- 11 Money Saving Challenges (The Quick & Painless Way to Save Money) – Living Lowkey

Truth is it can be intimidating to take the first step in building our emergency fund. I’ve to remind myself so many times to not be discouraged seeing other people’s milestones, to just follow my own pace. So that’s what I’m doing. One step at a time to figuringgitout.

I have read your article carefully and I agree with you very much. So, do you allow me to do this? I want to share your article link to my website: Cryptocurrency Prices

I am currently perfecting my thesis on gate.oi, and I found your article, thank you very much, your article gave me a lot of different ideas. But I have some questions, can you help me answer them?

I just wanted to thank you for the fast service. in addition to they look great. I received them a day earlier than expected. cherish the I will definitely continue to buy from this site. anyway I will recommend this site to my friends. Thanks!

cheap jordans https://www.realjordansretro.com/

I just wanted to thank you for the fast service. or they look great. I received them a day earlier than expected. for instance the I will definitely continue to buy from this site. situation I will recommend this site to my friends. Thanks!

cheap jordans online https://www.realcheapretrojordanshoes.com/

I just wanted to thank you for the fast service. or even a they look great. I received them a day earlier than expected. for instance the I will definitely continue to buy from this site. regardless I will recommend this site to my friends. Thanks!

cheap louis vuitton online https://www.louisvuittonsoutletstore.com/

I just wanted to thank you for the fast service. nor they look great. I received them a day earlier than expected. since the I will definitely continue to buy from this site. either way I will recommend this site to my friends. Thanks!

cheap jordan shoes https://www.cheaprealjordan.com/

cheap tadalafil 5mg cheap tadalafil 5mg medicine for erectile

buy duricef 250mg for sale buy proscar proscar 5mg us

diflucan online buy buy generic ampicillin buy ciprofloxacin for sale

buy estrace 1mg online estradiol 1mg uk order minipress

I would like to show thanks to the writer for rescuing me from this particular difficulty. As a result of scouting through the world-wide-web and getting proposals which were not productive, I figured my entire life was done. Existing without the presence of solutions to the difficulties you’ve resolved by way of your article is a crucial case, as well as ones that might have negatively damaged my career if I hadn’t discovered your blog. Your primary ability and kindness in playing with everything was tremendous. I’m not sure what I would’ve done if I hadn’t discovered such a step like this. It’s possible to at this time look forward to my future. Thanks a lot so much for the reliable and sensible help. I won’t hesitate to refer your blog to anybody who will need guide about this matter.

At the beginning, I was still puzzled. Since I read your article, I have been very impressed. It has provided a lot of innovative ideas for my thesis related to gate.io. Thank u. But I still have some doubts, can you help me? Thanks.

cheap metronidazole 400mg how to get cephalexin without a prescription order keflex 250mg for sale

buy vermox sale mebendazole oral tadalis price

Thank you so much for providing individuals with an extremely special chance to read from this web site. It is often very awesome and also full of a great time for me personally and my office acquaintances to search your blog nearly thrice weekly to see the latest issues you have got. And lastly, we are actually motivated considering the cool hints served by you. Some 3 tips in this article are undoubtedly the most beneficial we have all had.

At the beginning, I was still puzzled. Since I read your article, I have been very impressed. It has provided a lot of innovative ideas for my thesis related to gate.io. Thank u. But I still have some doubts, can you help me? Thanks.

Thank you for every one of your hard work on this web site. Ellie really likes participating in research and it’s really easy to understand why. Most of us notice all regarding the powerful method you make useful things via your website and as well encourage participation from other people on that area plus our favorite simple princess is always being taught a lot. Enjoy the remaining portion of the year. You have been conducting a superb job.

buy clindamycin medication brand erythromycin 250mg buy fildena online cheap

oral avanafil 200mg buy generic avana 100mg buy diclofenac 100mg pill

I have to point out my gratitude for your generosity giving support to folks that have the need for guidance on this particular concept. Your personal dedication to passing the solution all around turned out to be astonishingly useful and has continuously helped men and women like me to get to their objectives. Your own insightful help and advice denotes a great deal a person like me and further more to my office colleagues. Thanks a ton; from everyone of us.

indocin 75mg tablet brand cefixime 200mg cefixime pill

Read reviews and was a little hesitant since I had already inputted my order. or to but thank god, I had no issues. the same as the received item in a timely matter, they are in new condition. blue jays so happy I made the purchase. Will be definitely be purchasing again.

louis vuittons outlet https://www.louisvuittonsoutletonline.com/

nolvadex 10mg generic oral rhinocort order cefuroxime

Read reviews and was a little hesitant since I had already inputted my order. and but thank god, I had no issues. most notably received item in a timely matter, they are in new condition. direction so happy I made the purchase. Will be definitely be purchasing again.

jordans for cheap https://www.cheapjordanssneakers.com/

I as well as my pals have already been reading the good tips and hints located on your web blog then then came up with a terrible feeling I had not thanked the web blog owner for them. All of the guys became certainly happy to learn all of them and have in effect really been tapping into these things. Many thanks for simply being indeed thoughtful and then for having such very good guides most people are really desirous to understand about. Our own honest apologies for not expressing appreciation to earlier.

I have to get across my affection for your kindness supporting men who have the need for assistance with this situation. Your personal commitment to passing the solution all-around appears to be incredibly beneficial and have continually encouraged professionals just like me to arrive at their endeavors. Your personal warm and friendly tips and hints can mean a whole lot a person like me and a whole lot more to my office workers. Thank you; from all of us.

cheap amoxicillin 250mg order trimox without prescription buy clarithromycin without prescription

My wife and i felt delighted that Edward managed to finish up his investigations through your ideas he received out of the site. It is now and again perplexing to simply always be offering tips that the rest could have been trying to sell. Therefore we already know we now have the website owner to be grateful to because of that. All of the illustrations you’ve made, the easy site navigation, the relationships your site help instill – it is everything excellent, and it’s really helping our son in addition to our family believe that this issue is amusing, which is exceedingly serious. Many thanks for all!

Read reviews and was a little hesitant since I had already inputted my order. and also but thank god, I had no issues. much like the received item in a timely matter, they are in new condition. an invaluable so happy I made the purchase. Will be definitely be purchasing again.

cheap jordans https://www.realjordansshoes.com/

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.com/zh-CN/register?ref=JHQQKNKN

bimatoprost drug purchase robaxin sale desyrel 100mg us

Needed to draft you one tiny observation so as to thank you yet again for the superb basics you have discussed above. It was simply seriously open-handed with you to convey without restraint what exactly many individuals could possibly have marketed as an e book to make some profit for themselves, chiefly considering that you might well have tried it if you ever desired. Those tips also worked to be the good way to fully grasp that some people have a similar dreams just like mine to understand more related to this problem. I am sure there are a lot more pleasurable instances up front for people who take a look at your blog.

how to buy clonidine brand meclizine 25 mg tiotropium bromide 9mcg pills

I wanted to write down a brief word in order to thank you for all of the magnificent secrets you are placing on this website. My particularly long internet lookup has now been honored with useful facts to talk about with my contacts. I ‘d express that many of us readers are very endowed to dwell in a superb community with so many lovely individuals with interesting strategies. I feel really privileged to have discovered the web site and look forward to many more fabulous times reading here. Thanks again for everything.

suhagra 100mg brand buy aurogra medication sildalis online

order generic minocycline 50mg actos 30mg pills buy pioglitazone generic

I simply wanted to compose a small comment to be able to express gratitude to you for these pleasant ways you are showing at this website. My time-consuming internet look up has at the end of the day been compensated with good quality facts and techniques to write about with my pals. I ‘d declare that many of us visitors are extremely lucky to live in a remarkable site with so many marvellous professionals with beneficial tactics. I feel quite happy to have used your entire web page and look forward to tons of more entertaining minutes reading here. Thanks a lot once again for all the details.

buy generic isotretinoin 10mg buy azithromycin 500mg online cheap order zithromax 250mg for sale

buy leflunomide without prescription order viagra pill purchase sulfasalazine generic

I intended to post you a little note to say thanks over again for your lovely concepts you have provided on this website. This is really generous of people like you in giving unhampered all that a number of us might have sold for an e book in order to make some bucks on their own, most importantly seeing that you might have tried it if you decided. These suggestions additionally worked to provide a great way to comprehend someone else have a similar interest just as mine to know the truth much more when considering this issue. I am sure there are some more enjoyable instances ahead for people who examine your blog.

I definitely wanted to type a simple remark to appreciate you for all of the awesome items you are giving out on this site. My time-consuming internet look up has finally been compensated with good strategies to exchange with my visitors. I would assert that most of us website visitors actually are truly lucky to dwell in a wonderful network with very many brilliant professionals with helpful ideas. I feel very much privileged to have seen the web pages and look forward to tons of more awesome moments reading here. Thanks a lot again for all the details.

generic for cialis usa pharmacy viagra cialis without a doctor prescription

azithromycin 250mg ca order azithromycin 250mg online cheap neurontin tablet

I truly wanted to construct a word to be able to thank you for all the lovely hints you are writing at this site. My time intensive internet lookup has at the end of the day been recognized with extremely good know-how to write about with my family and friends. I would claim that we website visitors are unequivocally blessed to live in a remarkable website with so many outstanding people with helpful opinions. I feel really lucky to have used your entire web site and look forward to many more entertaining times reading here. Thanks once more for all the details.

ivermectin brand name prednisone 10mg usa deltasone brand

My spouse and i ended up being so lucky when Raymond managed to conclude his studies from your ideas he grabbed while using the web site. It is now and again perplexing to just choose to be giving out things people could have been making money from. So we do understand we’ve got the website owner to appreciate because of that. All of the illustrations you made, the easy website navigation, the relationships you give support to create – it’s all extraordinary, and it’s really leading our son and us imagine that the subject is brilliant, and that’s highly serious. Thanks for the whole lot!

brand lasix 40mg doxycycline pill albuterol pills

I simply wished to appreciate you once again. I do not know what I would have carried out in the absence of the entire recommendations shown by you directly on my concern. It was an absolute traumatic scenario in my opinion, nevertheless seeing the very specialized technique you processed the issue made me to jump for contentment. Now i am happy for your information and thus hope that you know what an amazing job that you’re undertaking training others using a site. I am sure you’ve never encountered any of us.

I wish to convey my admiration for your kindness supporting persons who should have assistance with your idea. Your personal commitment to passing the message all through had become extraordinarily significant and has permitted associates like me to achieve their targets. Your personal helpful advice indicates a great deal to me and especially to my colleagues. Best wishes; from everyone of us.

vardenafil 10mg over the counter zanaflex sale plaquenil 400mg usa

I want to express some thanks to this writer just for rescuing me from this difficulty. Just after searching through the internet and coming across strategies that were not beneficial, I figured my entire life was done. Living devoid of the approaches to the difficulties you’ve fixed all through your entire posting is a critical case, and the ones that could have negatively damaged my career if I had not discovered the blog. Your personal know-how and kindness in dealing with all the stuff was crucial. I’m not sure what I would’ve done if I hadn’t come across such a subject like this. I can also at this point look forward to my future. Thank you very much for your reliable and effective guide. I will not hesitate to recommend the blog to anybody who wants and needs counselling about this subject matter.

altace ca buy altace online cheap arcoxia 60mg usa

I would like to express thanks to this writer just for bailing me out of this dilemma. As a result of browsing throughout the search engines and coming across proposals which were not helpful, I was thinking my entire life was over. Being alive without the presence of solutions to the difficulties you’ve resolved as a result of your write-up is a crucial case, and ones that might have badly damaged my entire career if I hadn’t come across your site. Your knowledge and kindness in playing with all the stuff was invaluable. I don’t know what I would have done if I hadn’t encountered such a thing like this. I can also at this point relish my future. Thanks so much for the expert and amazing help. I will not be reluctant to suggest the blog to anybody who would like tips on this subject matter.

levitra 10mg price tizanidine pills hydroxychloroquine 400mg for sale

buy cheap asacol irbesartan drug avapro 150mg sale

I intended to send you one very little word in order to give thanks again for these striking knowledge you’ve documented on this site. It’s so extremely generous with you to provide publicly all a few people could have offered for an electronic book to help make some profit on their own, particularly considering the fact that you could possibly have done it if you ever desired. The solutions additionally served like the great way to recognize that some people have a similar keenness just like mine to learn much more on the subject of this condition. I’m sure there are several more fun opportunities ahead for folks who take a look at your website.

buy benicar tablets buy benicar pill divalproex for sale

clobetasol cheap order buspirone pill cordarone 100mg over the counter

I want to get across my passion for your kind-heartedness supporting all those that should have help with in this situation. Your special commitment to getting the message around was particularly invaluable and has continuously allowed people much like me to realize their desired goals. Your amazing informative facts denotes a whole lot to me and extremely more to my office workers. With thanks; from everyone of us.

order acetazolamide 250mg generic buy azathioprine online cheap buy imuran online cheap

I am commenting to let you be aware of of the beneficial discovery my girl had reading through yuor web blog. She discovered some details, which include what it is like to possess a great coaching heart to get men and women with ease completely grasp a variety of advanced matters. You undoubtedly did more than people’s desires. Many thanks for distributing the helpful, dependable, explanatory and unique tips about the topic to Lizeth.

coreg 25mg brand coreg 6.25mg price aralen 250mg ca

Some really nice and useful information on this web site, as well I conceive the pattern has excellent features.

lanoxin 250 mg pill buy digoxin 250 mg generic buy molnupiravir 200mg online cheap

My spouse and i have been so fortunate Jordan managed to carry out his basic research from the ideas he gained in your web page. It’s not at all simplistic to just choose to be giving for free tips and tricks that people today could have been selling. And we see we now have the writer to give thanks to because of that. Most of the explanations you’ve made, the simple website navigation, the relationships you will make it easier to engender – it is many excellent, and it is leading our son and our family do think that situation is interesting, and that’s unbelievably fundamental. Many thanks for everything!

I together with my pals appeared to be going through the nice thoughts on the blog and at once I had a horrible feeling I had not thanked the website owner for those tips. Those young men became happy to study all of them and already have simply been using them. We appreciate you simply being really considerate and also for considering such magnificent topics most people are really desperate to understand about. My sincere regret for not expressing appreciation to you sooner.

naproxen 500mg drug order omnicef 300mg generic buy lansoprazole paypal

I would like to point out my love for your generosity for all those that really want help with this particular concept. Your real commitment to passing the message throughout had become rather practical and has always enabled women much like me to realize their goals. Your warm and helpful help and advice entails a lot to me and much more to my office workers. Regards; from all of us.

albuterol 100 mcg canada buy pantoprazole 40mg online pyridium 200mg generic

I as well as my pals were checking the good key points on your website and quickly got a horrible suspicion I never thanked you for those tips. Those young boys were definitely excited to learn all of them and have in effect in reality been tapping into those things. We appreciate you turning out to be well kind as well as for deciding upon this sort of fantastic tips most people are really desperate to discover. Our own honest apologies for not saying thanks to you sooner.

montelukast 5mg us buy avlosulfon online cheap dapsone price

My wife and i got now relieved when Louis managed to carry out his investigation out of the ideas he obtained when using the weblog. It is now and again perplexing just to choose to be freely giving things which often people today might have been trying to sell. We really fully grasp we have got the writer to thank for that. Those explanations you made, the easy site menu, the friendships your site help create – it is all amazing, and it’s leading our son in addition to our family reckon that this concept is thrilling, and that is unbelievably mandatory. Many thanks for all the pieces!

olumiant 4mg uk buy metformin generic purchase lipitor generic

Thank you a lot for providing individuals with an extremely breathtaking possiblity to read articles and blog posts from this site. It really is so nice plus jam-packed with fun for me and my office fellow workers to search your website particularly 3 times per week to study the fresh issues you have got. Not to mention, I am also actually amazed with your sensational techniques you give. Certain 4 ideas in this posting are absolutely the best we have all had.

order nifedipine 10mg generic order fexofenadine sale fexofenadine 120mg ca

I wanted to make a remark to be able to say thanks to you for these wonderful tips you are writing on this site. My time-consuming internet research has at the end of the day been honored with extremely good facts and strategies to exchange with my family members. I ‘d admit that most of us readers actually are unquestionably fortunate to live in a fabulous network with very many brilliant professionals with helpful tricks. I feel truly lucky to have seen your entire website page and look forward to tons of more entertaining moments reading here. Thanks a lot once more for everything.

My husband and i ended up being so relieved when Emmanuel managed to conclude his studies via the ideas he received through your web site. It’s not at all simplistic to simply happen to be freely giving tactics which people today have been making money from. We really keep in mind we’ve got you to thank because of that. The specific explanations you have made, the simple website navigation, the relationships your site make it easier to foster – it’s mostly overwhelming, and it is letting our son and our family understand that concept is cool, and that’s particularly pressing. Thank you for all!

norvasc ca prinivil cost order prilosec 10mg

dapoxetine 90mg sale misoprostol where to buy buy xenical 120mg generic

purchase diltiazem generic diltiazem over the counter order allopurinol 100mg pills

metoprolol price buy atenolol pill medrol price

My spouse and i ended up being now comfortable when Edward could deal with his analysis via the precious recommendations he received through the web page. It’s not at all simplistic just to choose to be handing out strategies men and women could have been selling. We really fully grasp we now have the website owner to give thanks to for that. The type of illustrations you’ve made, the straightforward blog menu, the friendships you can help to instill – it’s got mostly excellent, and it’s really helping our son in addition to the family reckon that the issue is satisfying, and that is quite fundamental. Thank you for all!

order generic triamcinolone 10mg loratadine generic loratadine price

purchase rosuvastatin pills rosuvastatin 10mg sale domperidone for sale online

I not to mention my friends were found to be reading through the best guidelines from your web page and suddenly I got a terrible feeling I never expressed respect to the site owner for them. The young boys happened to be consequently glad to learn them and have in effect pretty much been making the most of them. Appreciation for getting well helpful and also for using this kind of high-quality themes most people are really desirous to be informed on. Our sincere regret for not expressing appreciation to earlier.

I have to get across my respect for your kindness giving support to men and women that really want guidance on this one area of interest. Your personal dedication to passing the message all around came to be certainly useful and has continually allowed individuals like me to attain their endeavors. Your entire helpful report denotes much a person like me and still more to my office colleagues. Thanks a ton; from everyone of us.

sumycin price oral baclofen 10mg buy baclofen 10mg for sale

ampicillin over the counter cipro 500mg without prescription buy metronidazole 400mg generic

I simply needed to appreciate you once again. I’m not certain the things that I would have undertaken without the actual tips and hints shown by you over such situation. Completely was the traumatic situation for me personally, nevertheless noticing a professional style you handled it forced me to leap for delight. I am happy for this service and believe you realize what an amazing job that you’re putting in teaching most people through your web blog. Most likely you’ve never come across any of us.

buy generic ketorolac online order colcrys 0.5mg online cheap buy inderal online cheap

My spouse and i ended up being really cheerful Albert managed to finish off his preliminary research using the ideas he discovered when using the web site. It’s not at all simplistic just to be handing out guidelines most people may have been selling. Therefore we acknowledge we now have the blog owner to be grateful to because of that. The entire explanations you made, the easy site menu, the friendships you will help engender – it is many spectacular, and it is facilitating our son in addition to us know that that issue is excellent, which is certainly truly essential. Thank you for all!

bactrim 480mg generic cephalexin uk buy generic cleocin 300mg

clopidogrel pills buy methotrexate 2.5mg online warfarin 5mg sale

cost erythromycin erythromycin over the counter order nolvadex 20mg pills

reglan price how to buy metoclopramide esomeprazole 20mg generic

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/tr/register?ref=WTOZ531Y

A lot of thanks for all of the labor on this web page. My aunt really likes getting into investigation and it is easy to see why. Many of us know all concerning the compelling method you give reliable guidelines via your web blog and therefore welcome contribution from some other people on this situation so my child is without question studying a lot of things. Have fun with the remaining portion of the year. You have been conducting a really great job.

budesonide price bimatoprost cost bimatoprost brand

I wanted to write a small message in order to thank you for these magnificent steps you are giving on this site. My incredibly long internet lookup has at the end been rewarded with beneficial know-how to talk about with my contacts. I ‘d declare that most of us readers are undoubtedly lucky to be in a decent network with many wonderful individuals with beneficial things. I feel somewhat grateful to have encountered your entire webpage and look forward to plenty of more pleasurable moments reading here. Thanks a lot once again for all the details.

buy topiramate pills for sale buy topamax 200mg generic levaquin 500mg cheap

When someone writes an post he/she keeps the idea of a user in his/her mind that how a user can know it. So that’s why this piece of writing is perfect. Thanks!

Thanks a lot for giving everyone an extremely superb opportunity to discover important secrets from this web site. It really is very superb and as well , packed with a great time for me personally and my office fellow workers to search the blog no less than three times a week to read through the newest issues you have got. And of course, I am just at all times motivated considering the very good opinions you give. Certain 1 areas in this article are certainly the most efficient I have had.

cheap methocarbamol buy suhagra 100mg without prescription cheap sildenafil

dutasteride usa purchase ranitidine online buy mobic 15mg sale

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/sl/register?ref=DB40ITMB

order celecoxib 100mg flomax without prescription buy ondansetron 4mg generic

generic sildenafil 50mg buy sildenafil online where can i buy estrace

Perfect work you have done, this site is really cool with great information.

Heya i’m for the primary time here. I came across this board and I in finding It truly useful & it helped me out a lot. I hope to give something back and help others like you helped me.

purchase spironolactone sale valtrex 1000mg usa valtrex brand

получение медицинской справки

order lamictal 200mg pill buy generic lamictal for sale prazosin medication

Thanks for sharing such a nice thought, article is pleasant, thats why i have read it completely

finasteride 5mg sale buy sildenafil for sale real viagra 100mg

order generic retin gel avanafil uk order generic avana 200mg

buy cialis 5mg pill order cialis 40mg sale sildenafil 25mg for sale

whoah this blog is magnificent i really like studying your posts. Keep up the great paintings! You already know, a lot of people are looking around for this info, you can aid them greatly.

buy tadacip online cheap generic indocin buy indocin 75mg sale

cialis 10mg tablet buy cialis 40mg online cheap natural pills for erectile dysfunction

buy generic terbinafine 250mg cefixime medication amoxicillin pill

Everything is very open with a precise explanation of the issues. It was really informative. Your website is very helpful. Thanks for sharing!

buy sulfasalazine pills for sale buy azulfidine 500 mg without prescription purchase calan generic

I’ve been exploring for a little bit for any high-quality articles or blog posts in this kind of space . Exploring in Yahoo I finally stumbled upon this site. Reading this info So i’m satisfied to express that I have a very just right uncanny feeling I came upon exactly what I needed. I so much without a doubt will make certain to don?t forget this site and give it a look on a constant basis.

Your style is very unique compared to other people I have read stuff from. Thank you for posting when you have the opportunity, Guess I will just bookmark this site.

depakote order online buy generic diamox for sale buy isosorbide pills for sale

buy generic anastrozole over the counter order catapres 0.1 mg generic cheap catapres

There is definately a lot to know about this subject. I love all the points you’ve made.

What’s up, I desire to subscribe for this webpage to get most up-to-date updates, so where can i do it please help.

buy cheap generic imuran lanoxin 250mg ca order micardis 80mg online cheap

antivert canada tiotropium bromide uk buy cheap generic minocin

molnunat order cefdinir 300mg usa cefdinir 300mg canada

It’s awesome designed for me to have a site, which is useful in favor of my experience. thanks admin

male erection pills sildenafil overnight delivery sildenafil 100mg cost

buy lansoprazole 30mg pill albuterol oral cheap pantoprazole 40mg

This piece of writing is truly a good one it helps new net users, who are wishing for blogging.

buy pyridium tablets buy generic symmetrel for sale symmetrel for sale online

the best ed pill cialis tadalafil 20mg cialis coupons

Heya just wanted to give you a quick heads up and let you know a few of the images aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different internet browsers and both show the same results.

dapsone pills order aceon 4mg pill buy cheap aceon

My spouse and I stumbled over here coming from a different website and thought I might check things out. I like what I see so now i’m following you. Look forward to looking over your web page again.

where can i buy ed pills buy tadalafil 40mg online cheap tadalafil 10mg usa

buy generic fexofenadine online generic amaryl buy glimepiride tablets

No matter if some one searches for his essential thing, so he/she desires to be available that in detail, thus that thing is maintained over here.

What’s Happening i’m new to this, I stumbled upon this I have found It positively helpful and it has helped me out loads. I am hoping to give a contribution & assist other users like its helped me. Good job.

buy arcoxia generic astelin where to buy purchase azelastine without prescription

purchase terazosin generic generic pioglitazone 15mg buy cialis 10mg online cheap

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You clearly know what youre talking about, why waste your intelligence on just posting videos to your blog when you could be giving us something enlightening to read?

order irbesartan 300mg generic buy avapro medication buspar 10mg oral

how to buy cordarone generic coreg 6.25mg dilantin 100 mg price

buy albendazole without prescription buy albenza 400mg for sale provera 10mg generic

This is very interesting, You are an excessively professional blogger. I have joined your feed and look ahead to in quest of more of your magnificent post. Also, I have shared your web site in my social networks

If some one needs to be updated with most recent technologies then he must be pay a visit this site and be up to date every day.

Today, I went to the beachfront with my kids. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is completely off topic but I had to tell someone!

order praziquantel 600 mg online cheap order periactin without prescription buy cyproheptadine tablets

I am extremely inspired with your writing talents and alsosmartly as with the layout for your blog. Is this a paid subject or did you customize it yourself? Either way stay up the nice quality writing, it’s rare to peer a nice blog like this one these days..

buy oxybutynin 5mg pill oxybutynin for sale online alendronate 35mg canada

Does your site have a contact page? I’m having a tough time locating it but, I’d like to send you an e-mail. I’ve got some suggestions for your blog you might be interested in hearing. Either way, great site and I look forward to seeing it develop over time.

fluvoxamine 50mg oral fluvoxamine where to buy order duloxetine 40mg without prescription

Pretty section of content. I just stumbled upon your website and in accession capital to assert that I acquire in fact enjoyed account your blog posts. Any way I’ll be subscribing to your augment and even I achievement you access consistently rapidly.

macrodantin 100mg canada macrodantin 100mg ca buy generic nortriptyline for sale

Hi there I am so glad I found your website, I really found you by error, while I was browsing on Aol for something else, Nonetheless I am here now and would just like to say thanks a lot for a fantastic post and a all round exciting blog (I also love the theme/design), I dont have time to read through it all at the minute but I have book-marked it and also added in your RSS feeds, so when I have time I will be back to read much more, Please do keep up the superb b.

What a stuff of un-ambiguity and preserveness of precious knowledge about unexpected feelings.

purchase glipizide generic order glipizide 10mg generic order betamethasone 20 gm for sale

I really like what you guys are usually up too. This type of clever work and coverage! Keep up the excellent works guys I’ve you guys to blogroll.

order anafranil 25mg sale clomipramine order online buy progesterone cheap

buy panadol 500mg sale paracetamol 500mg tablet pepcid 20mg cost

Hi friends, how is everything, and what you want to say about this article, in my view its really remarkable for me.

I think the admin of this website is in fact working hard in favor of his web site, as here every data is quality based information.

order tinidazole 300mg pills purchase bystolic online cheap buy nebivolol generic

tacrolimus 1mg generic purchase ropinirole online cheap purchase ropinirole sale

Some really great blog posts on this web site, regards for contribution. “For today and its blessings, I owe the world an attitude of gratitude.” by Clarence E. Hodges.

Hey There. I found your blog using msn. This is a really well written article. I will be sure to bookmark it and come back to read more of your useful information. Thanks for the post. I’ll certainly return.

buy diovan online cheap buy valsartan 80mg generic order generic ipratropium 100mcg

buy rocaltrol without a prescription buy fenofibrate online cheap how to buy tricor

decadron for sale purchase nateglinide online nateglinide 120mg tablet

An impressive share! I have just forwarded this onto a coworker who was doing a little research on this. And he in fact bought me breakfast because I discovered it for him… lol. So let me reword this…. Thank YOU for the meal!! But yeah, thanx for spending the time to discuss this issue here on your web site.

buy oxcarbazepine 300mg without prescription trileptal 600mg generic buy ursodiol tablets

Great info. Lucky me I came across your website by accident (stumbleupon). I have saved it for later!

you are in point of fact a just right webmaster. The site loading speed is incredible. It sort of feels that you are doing any unique trick. Also, The contents are masterpiece. you have performed a magnificent task in this matter!

When I originally commented I seem to have clicked the -Notify me when new comments are added- checkbox and now every time a comment is added I recieve four emails with the same comment. Is there a means you can remove me from that service? Thanks!

order captopril 25mg generic buy carbamazepine 200mg order carbamazepine

Terrific article! This is the type of information that are meant to be shared around the internet. Disgrace on the seek engines for now not positioning this post upper! Come on over and talk over with my site . Thank you =)

This design is wicked! You most certainly know how to keep a reader entertained. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Wonderful job. I really enjoyed what you had to say, and more than that, how you presented it. Too cool!

Thanks for ones marvelous posting! I genuinely enjoyed reading it, you’re a great author. I will be sure to bookmark your blog and will eventually come back from now on. I want to encourage yourself to continue your great posts, have a nice morning!

I am extremely inspired with your writing talents and alsowell as with the format on your blog. Is this a paid subject or did you customize it yourself? Either way stay up the nice quality writing, it’s rare to see a nice blog like this one these days..

Hey! Would you mind if I share your blog with my twitter group? There’s a lot of people that I think would really enjoy your content. Please let me know. Cheers

Hey! Quick question that’s entirely off topic. Do you know how to make your site mobile friendly? My web site looks weird when viewing from my iphone4. I’m trying to find a theme or plugin that might be able to correct this problem. If you have any suggestions, please share. With thanks!

order zyban 150mg for sale buy cetirizine 10mg online strattera online

buy ciplox 500 mg pill order lincomycin 500mg generic buy generic duricef

My relatives always say that I am wasting my time here at net, but I know I am getting knowledge daily by reading such good articles or reviews.

Nice blog here! Also your site loads up fast! What host are you using? Can I get your affiliate link to your host? I wish my website loaded up as fast as yours lol

oral seroquel 50mg escitalopram 20mg generic buy cheap escitalopram

buy lamivudine for sale zidovudine 300 mg usa brand quinapril 10mg

This is very fascinating, You are an excessively professional blogger. I have joined your feed and sit up for in quest of more of your magnificent post. Also, I have shared your web site in my social networks

At this time I am going to do my breakfast, once having my breakfast coming yet again to read additional news.

frumil 5 mg tablet buy differin generic buy acivir cream

order prozac generic naltrexone pill order femara 2.5mg

Looking forward to reading more. Great blog article.Thanks Again. Much obliged.

This web site truly has all of the information I wanted about this subject and didn’t know who to ask.

Very informative post.Really looking forward to read more. Awesome.

I was able to find good information from your blog posts.

Excellent write-up. I certainly love this website. Continue the good work!

valcivir 1000mg tablet bactrim without prescription purchase floxin for sale

order bisoprolol online buy bisoprolol generic oxytetracycline buy online

Very neat post.Thanks Again.

levetiracetam generic buy bactrim cheap viagra 50mg

Appreciate you sharing, great blog article. Awesome.

Very informative article. Much obliged.

Hmm it appears like your site ate my first comment (it was extremely long) so I guess I’ll just sum it up what I submitted and say, I’m thoroughly enjoying your blog. I as well am an aspiring blog blogger but I’m still new to the whole thing. Do you have any recommendations for first-time blog writers? I’d certainly appreciate it.

buy cefpodoxime without prescription order flixotide generic buy cheap generic flixotide

Really enjoyed this blog. Really Great.

I am sure this article has touched all the internet users, its really really nice article on building up new blog.

Thanks so much for the blog post.Really looking forward to read more. Cool.

Неповторимый мужской эротический массаж в Москве база вип спа

Thank you ever so for you post.Really looking forward to read more. Will read on…

Major thanks for the post.Much thanks again. Really Great.

With havin so much content and articles do you ever run into any problems of plagorism or copyright violation? My website has a lot of completely unique content I’ve either authored myself or outsourced but it looks like a lot of it is popping it up all over the web without my agreement. Do you know any solutions to help protect against content from being ripped off? I’d certainly appreciate it.

I cannot thank you enough for the article post.Thanks Again. Keep writing.

I am so grateful for your blog.Really looking forward to read more.

I loved your post. Keep writing.

cialis for men sildenafil online order viagra 100mg without prescription

A round of applause for your blog. Great.

Greetings! Very helpful advice within this article! It is the little changes that make the most important changes. Thanks a lot for sharing!

buy precose for sale buy repaglinide 1mg griseofulvin 250mg ca

I always spent my half an hour to read this website’s articles everyday along with a cup of coffee.

Im obliged for the blog post. Great.

Terrific article! This is the type of information that are supposed to be shared around the internet. Disgrace on the seek engines for now not positioning this submit upper! Come on over and talk over with my web site . Thank you =)

I constantly emailed this website post page to all my associates, as if like to read it after that my friends will too.

Thanks for the article post.Thanks Again. Really Great.

Sweet blog! I found it while surfing around on Yahoo News. Do you have any tips on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Cheers

Hiya! I know this is kinda off topic nevertheless I’d figured I’d ask. Would you be interested in exchanging links or maybe guest writing a blog article or vice-versa? My website goes over a lot of the same subjects as yours and I believe we could greatly benefit from each other. If you happen to be interested feel free to send me an e-mail. I look forward to hearing from you! Awesome blog by the way!

I like the valuable information you provide in your articles. I will bookmark your weblog and check again here frequently. I am quite certain I will learn a lot of new stuff right here! Good luck for the next!

I don’t even know how I ended up here, but I thought this post was good. I don’t know who you are but definitely you are going to a famous blogger if you are not already 😉 Cheers!

how to buy minoxidil buy cialis 5mg cheap erectile dysfunction pills

Wonderful blog! I found it while surfing around on Yahoo News. Do you have any tips on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Thank you

I was recommended this website by my cousin. I’m not sure whether this post is written by him as nobody else know such detailed about my difficulty. You’re incredible! Thanks!

Your place is valueble for me. Thanks!…

Asking questions are in fact pleasant thing if you are not understanding anything entirely, except this post provides good understanding even.

Very nice post. I just stumbled upon your blog and wished to mention that I’ve really loved surfing around your weblog posts. In any case I’ll be subscribing for your feed and I am hoping you write once more very soon!

Im not that much of a online reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your site to come back in the future. All the best

I was able to find good info from your blog articles.

dipyridamole 25mg oral pravachol 20mg canada order pravachol 20mg pills

generic aspirin levoflox 250mg uk brand imiquad

Hey there, You have performed an excellent job. I will definitely digg it and individually recommend to my friends. I am sure they will be benefited from this site.

I really like your blog.. very nice colors & theme. Did you make this website yourself or did you hire someone to do it for you? Plz reply as I’m looking to design my own blog and would like to know where u got this from. kudos

One thing I’d really like to say is that often car insurance cancellation is a horrible experience and if you are doing the right things as a driver you will not get one. A lot of people do obtain the notice that they’ve been officially dumped by the insurance company and many have to scramble to get further insurance from a cancellation. Inexpensive auto insurance rates tend to be hard to get after having a cancellation. Knowing the main reasons concerning the auto insurance termination can help drivers prevent burning off one of the most important privileges readily available. Thanks for the thoughts shared by your blog.

Fantastic blog.Much thanks again. Fantastic.

I really enjoy the article.Really looking forward to read more. Will read on…

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get three emails with the same comment. Is there any way you can remove me from that service? Bless you!

buy melatonin sale desogestrel 0.075mg brand purchase danocrine online cheap

Its like you read my mind! You seem to know so much about this, like you wrote the book in it or something. I think that you could do with some pics to drive the message home a bit, but other than that, this is great blog. An excellent read. I’ll definitely be back.

I think this is one of the most significant information for me. And i’m glad reading your article. But want to remark on few general things, The site style is great, the articles is really nice : D. Good job, cheers

Wow that was odd. I just wrote an really long comment but after I clicked submit my comment didn’t show up. Grrrr… well I’m not writing all that over again. Anyways, just wanted to say wonderful blog!

I’ve learned a few important things by means of your post. I’d personally also like to say that there will be a situation where you will make application for a loan and do not need a co-signer such as a Federal government Student Support Loan. In case you are getting a loan through a conventional financial institution then you need to be prepared to have a co-signer ready to assist you. The lenders will base their decision using a few variables but the greatest will be your credit score. There are some financial institutions that will also look at your work history and choose based on that but in most cases it will be based on on your ranking.

Wow! This could be one particular of the most helpful blogs We have ever arrive across on this subject. Actually Great. I’m also a specialist in this topic therefore I can understand your effort.

Thanks for your post. I want to say that the expense of car insurance varies greatly from one insurance policy to another, mainly because there are so many different issues which bring about the overall cost. As an example, the brand name of the car or truck will have an enormous bearing on the price tag. A reliable old family automobile will have a more economical premium than a flashy sports car.

The things i have usually told folks is that when looking for a good on the net electronics retail store, there are a few components that you have to take into consideration. First and foremost, you should really make sure to choose a reputable as well as reliable retail store that has gotten great opinions and classification from other customers and marketplace advisors. This will make sure that you are dealing with a well-known store that provides good program and assistance to its patrons. Thanks for sharing your opinions on this site.

order duphaston 10 mg sale buy januvia 100mg online order empagliflozin pills

I believe this is one of the most vital info for me. And i’m glad reading your article. But want to remark on some normal issues, The web site taste is perfect, the articles is really excellent : D. Just right activity, cheers

At this time it sounds like BlogEngine is the best blogging platform available right now. (from what I’ve read) Is that what you are using on your blog?

romanian adventure

This is very interesting, You are a very skilled blogger. I have joined your feed and look forward to seeking more of your wonderful post. Also, I have shared your site in my social networks!

Hi, I do think your website might be having browser compatibility issues. When I look at your website in Safari, it looks fine however, if opening in Internet Explorer, it has some overlapping issues. I simply wanted to give you a quick heads up! Besides that, fantastic blog!

order prasugrel 10mg buy prasugrel tolterodine pills

If some one needs to be updated with latest technologies then he must be go to see this website and be up to date every day.

I just couldn’t depart your website before suggesting that I actually enjoyed the standard information a person provide for your visitors? Is gonna be back often to check up on new posts

I’m really impressed with your writing skills and also with the layout on your weblog. Is this a paid theme or did you modify it yourself? Either way keep up the nice quality writing, it is rare to see a great blog like this one nowadays..

To announce actual news, ape these tips:

Look representing credible sources: http://nature-et-avenir.org/files/pages/?what-is-a-video-news-release.html. It’s high-ranking to ensure that the news origin you are reading is reliable and unbiased. Some examples of reliable sources categorize BBC, Reuters, and The Different York Times. Read multiple sources to pick up a well-rounded aspect of a isolated info event. This can better you carp a more ended display and avoid bias. Be hep of the perspective the article is coming from, as even reputable telecast sources can contain bias. Fact-check the dirt with another fountain-head if a news article seems too lurid or unbelievable. Till the end of time pass sure you are reading a fashionable article, as scandal can change quickly.

By following these tips, you can become a more aware of rumour reader and better apprehend the cosmos about you.

I really liked your blog post.Really thank you! Much obliged.

Great blog article. Want more.

Really enjoyed this article post.Thanks Again. Want more.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You clearly know what youre talking about, why waste your intelligence on just posting videos to your blog when you could be giving us something enlightening to read?

I’m not sure why but this blog is loading extremely slow for me. Is anyone else having this issue or is it a problem on my end? I’ll check back later and see if the problem still exists.

Hi, i think that i saw you visited my website so i came to return the favor.I am trying to find things to improve my site!I suppose its ok to use some of your ideas!!

At this time I am going away to do my breakfast, when having my breakfast coming yet again to read more news.

В нашем онлайн казино вы найдете широкий спектр слотов и лайв игр, присоединяйтесь.

Вы ищете надежное и захватывающее онлайн-казино, тогда это идеальное место для вас!

It is perfect time to make some plans for the future and it is time to be happy. I have read this post and if I could I want to suggest you few interesting things or suggestions. Perhaps you could write next articles referring to this article. I wish to read more things about it!

Hi there Dear, are you really visiting this web site daily, if so after that you will absolutely get good experience.

Hi there! Do you use Twitter? I’d like to follow you if that would be ok. I’m definitely enjoying your blog and look forward to new updates.

Hey there! Someone in my Myspace group shared this site with us so I came to look it over. I’m definitely enjoying the information. I’m book-marking and will be tweeting this to my followers! Terrific blog and fantastic design and style.

Thanks for your advice on this blog. 1 thing I want to say is the fact purchasing electronics items on the Internet is certainly not new. In truth, in the past several years alone, the marketplace for online electronic devices has grown drastically. Today, you could find practically just about any electronic device and product on the Internet, including cameras and camcorders to computer spare parts and game playing consoles.

Thanks for your write-up. I also think laptop computers have gotten more and more popular nowadays, and now tend to be the only kind of computer employed in a household. It is because at the same time that they are becoming more and more economical, their processing power keeps growing to the point where there’re as effective as personal computers through just a few in years past.

Thanks for your blog post. I would also love to say that the health insurance specialist also works well with the benefit of the particular coordinators of any group insurance policy. The health broker is given a listing of benefits searched for by anyone or a group coordinator. What any broker will is search for individuals or maybe coordinators that best complement those needs. Then he presents his recommendations and if each party agree, the particular broker formulates binding agreement between the two parties.

Hey there would you mind letting me know which hosting company you’re using? I’ve loaded your blog in 3 different internet browsers and I must say this blog loads a lot quicker then most. Can you recommend a good hosting provider at a fair price? Kudos, I appreciate it!

Audio began playing when I opened this web page, so frustrating!

You really make it seem so easy with your presentation but I find this matter to be actually something which I think I would never understand. It seems too complicated and very broad for me. I am looking forward for your next post, I will try to get the hang of it!

Hello just wanted to give you a quick heads up. The words in your article seem to be running off the screen in Firefox. I’m not sure if this is a formatting issue or something to do with internet browser compatibility but I thought I’d post to let you know. The design and style look great though! Hope you get the issue solved soon. Many thanks

Can I simply say what a aid to find somebody who actually is aware of what theyre speaking about on the internet. You definitely know methods to bring a problem to gentle and make it important. More people must learn this and understand this side of the story. I cant believe youre no more standard because you positively have the gift.

Hello, i think that i noticed you visited my website thus i came to ?go back the desire?.I’m attempting to in finding things to improve my website!I suppose its adequate to make use of some of your concepts!!

One more thing. In my opinion that there are several travel insurance web sites of trustworthy companies that permit you to enter holiday details to get you the quotations. You can also purchase this international travel insurance policy on-line by using your current credit card. Everything you should do is usually to enter all your travel information and you can start to see the plans side-by-side. Just find the plan that suits your capacity to pay and needs and after that use your credit card to buy them. Travel insurance online is a good way to check for a respected company with regard to international travel cover. Thanks for revealing your ideas.

Another thing is that when evaluating a good on-line electronics store, look for online shops that are continually updated, keeping up-to-date with the hottest products, the most effective deals, as well as helpful information on products. This will ensure you are dealing with a shop that really stays over the competition and gives you what you should need to make knowledgeable, well-informed electronics buys. Thanks for the vital tips I’ve learned through your blog.

Thanks for expressing your ideas. Something is that students have a solution between federal government student loan along with a private education loan where it really is easier to go for student loan debt consolidation loan than through the federal student loan.

Thanks , I’ve just been searching for info about this subject for ages and yours is the best I’ve discovered till now. But, what about the bottom line? Are you sure about the source?

Thanks for the article. My partner and i have usually observed that a lot of people are desperate to lose weight since they wish to look slim and also attractive. Even so, they do not constantly realize that there are more benefits so that you can losing weight in addition. Doctors state that over weight people are afflicted with a variety of health conditions that can be directly attributed to the excess weight. The great news is that people who sadly are overweight as well as suffering from different diseases can help to eliminate the severity of their own illnesses by way of losing weight. It is possible to see a continuous but marked improvement with health while even a bit of a amount of weight-loss is realized.

I do enjoy the manner in which you have framed this specific problem plus it really does provide me personally a lot of fodder for consideration. Nevertheless, from everything that I have personally seen, I only hope when other feed-back stack on that folks continue to be on issue and in no way embark on a soap box of some other news du jour. Yet, thank you for this superb piece and although I do not necessarily concur with this in totality, I regard your viewpoint.

I do believe that a property foreclosure can have a important effect on the applicant’s life. Mortgage foreclosures can have a Seven to a decade negative influence on a debtor’s credit report. A new borrower who’s applied for home financing or virtually any loans for that matter, knows that the particular worse credit rating is definitely, the more tricky it is to have a decent loan. In addition, it could possibly affect any borrower’s power to find a respectable place to lease or hire, if that gets the alternative housing solution. Interesting blog post.

garland dentist

Thanks for the helpful posting. It is also my opinion that mesothelioma has an particularly long latency interval, which means that signs and symptoms of the disease may well not emerge right until 30 to 50 years after the original exposure to mesothelioma. Pleural mesothelioma, that is the most common style and has an effect on the area round the lungs, may cause shortness of breath, upper body pains, and also a persistent cough, which may cause coughing up bloodstream.

Good day! I know this is kinda off topic but I was wondering which blog platform are you using for this site? I’m getting fed up of WordPress because I’ve had issues with hackers and I’m looking at alternatives for another platform. I would be great if you could point me in the direction of a good platform.

It?s really a great and useful piece of information. I am glad that you shared this useful info with us. Please keep us informed like this. Thanks for sharing.

Amazing! This blog looks just like my old one! It’s on a totally different subject but it has pretty much the same page layout and design. Excellent choice of colors!

The information shared is of top quality which has to get appreciated at all levels. Well done…

Something more important is that while looking for a good on the net electronics store, look for web shops that are frequently updated, keeping up-to-date with the hottest products, the perfect deals, plus helpful information on goods and services. This will make sure that you are doing business with a shop that really stays on top of the competition and offers you what you ought to make knowledgeable, well-informed electronics acquisitions. Thanks for the important tips I have learned from the blog.

excellent points altogether, you simply gained a brand new reader. What would you recommend in regards to your post that you made some days ago? Any positive?

I will immediately grab your rss feed as I can’t to find your email subscription link or newsletter service. Do you have any? Kindly let me recognize so that I may subscribe. Thanks.

I have witnessed that sensible real estate agents everywhere you go are Promoting. They are knowing that it’s not just placing a poster in the front place. It’s really regarding building relationships with these traders who one of these days will become consumers. So, once you give your time and effort to assisting these dealers go it alone – the “Law involving Reciprocity” kicks in. Thanks for your blog post.

I’ve learned a number of important things by means of your post. I’d personally also like to express that there may be situation in which you will obtain a loan and never need a co-signer such as a Federal Student Aid Loan. When you are getting that loan through a classic bank then you need to be made ready to have a co-signer ready to assist you. The lenders will probably base their decision on a few issues but the biggest will be your credit standing. There are some loan providers that will additionally look at your job history and determine based on that but in many instances it will depend on your report.

Pretty nice post. I just stumbled upon your blog and wanted to say that I’ve really enjoyed surfing around your blog posts. After all I?ll be subscribing to your rss feed and I hope you write again very soon!

Today, I went to the beach with my kids. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She placed the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is entirely off topic but I had to tell someone!

What i don’t realize is in truth how you are not really a lot more well-preferred than you may be right now. You’re very intelligent. You recognize thus significantly in relation to this subject, made me individually imagine it from numerous numerous angles. Its like men and women aren’t involved except it’s one thing to accomplish with Woman gaga! Your personal stuffs outstanding. Always handle it up!

Thanks for giving your ideas. Another thing is that college students have a choice between federal government student loan plus a private education loan where it is easier to opt for student loan consolidation than with the federal education loan.

Thanks for the thoughts you are discussing on this blog site. Another thing I want to say is the fact that getting hold of copies of your credit rating in order to examine accuracy of the detail will be the first motion you have to undertake in credit restoration. You are looking to thoroughly clean your credit reports from damaging details faults that ruin your credit score.

Thank you so much for sharing this wonderful post with us.

Great post here. One thing I would like to say is that most professional domains consider the Bachelors Degree like thejust like the entry level standard for an online education. When Associate Diplomas are a great way to get started on, completing your current Bachelors reveals many good opportunities to various professions, there are numerous online Bachelor Diploma Programs available via institutions like The University of Phoenix, Intercontinental University Online and Kaplan. Another thing is that many brick and mortar institutions give Online variations of their degree programs but usually for a substantially higher fee than the firms that specialize in online diploma plans.

Very nice post. I just stumbled upon your blog and wished to mention that I’ve truly loved surfing around your weblog posts. After all I will be subscribing on your rss feed and I’m hoping you write again very soon!

Thank you so much for sharing this wonderful post with us.

Music started playing anytime I opened this web-site, so irritating!

Howdy would you mind letting me know which webhost you’re utilizing? I’ve loaded your blog in 3 completely different web browsers and I must say this blog loads a lot faster then most. Can you suggest a good internet hosting provider at a reasonable price? Thank you, I appreciate it!

I have learned some points through your site post. One other thing I would like to say is that there are many games available on the market designed specially for toddler age young children. They consist of pattern recognition, colors, creatures, and designs. These often focus on familiarization as opposed to memorization. This makes little ones occupied without having a sensation like they are studying. Thanks

It’s my opinion that a property foreclosures can have a important effect on the borrower’s life. House foreclosures can have a Six to decade negative affect on a client’s credit report. A new borrower who has applied for a home loan or virtually any loans for example, knows that the particular worse credit rating can be, the more hard it is to secure a decent personal loan. In addition, it may possibly affect a borrower’s ability to find a quality place to lease or rent, if that will become the alternative property solution. Great blog post.

It is perfect time to make some plans for the future and it’s time to be happy. I have read this post and if I could I wish to suggest you few interesting things or tips. Maybe you can write next articles referring to this article. I want to read more things about it!

Another important issue is that if you are an older person, travel insurance for pensioners is something you ought to really contemplate. The mature you are, the more at risk you’re for permitting something poor happen to you while overseas. If you are not necessarily covered by a few comprehensive insurance, you could have a few serious complications. Thanks for revealing your suggestions on this blog.

I will also like to mention that most individuals that find themselves without health insurance are typically students, self-employed and those that are out of work. More than half from the uninsured are under the age of Thirty-five. They do not experience they are looking for health insurance simply because they’re young as well as healthy. Their particular income is frequently spent on real estate, food, along with entertainment. A lot of people that do go to work either whole or not professional are not offered insurance via their jobs so they proceed without with the rising valuation on health insurance in america. Thanks for the thoughts you share through this website.

I have been absent for a while, but now I remember why I used to love this site. Thanks , I will try and check back more frequently. How frequently you update your site?

Thanks a lot for the helpful post. It is also my belief that mesothelioma has an particularly long latency time period, which means that symptoms of the disease may well not emerge until finally 30 to 50 years after the first exposure to asbestos fiber. Pleural mesothelioma, that’s the most common type and impacts the area round the lungs, could cause shortness of breath, chest muscles pains, and a persistent coughing, which may cause coughing up blood.

Hello there, You’ve performed a fantastic job. I?ll certainly digg it and in my view recommend to my friends. I’m sure they’ll be benefited from this web site.

of course like your web-site but you need to check the spelling on several of your posts. Several of them are rife with spelling issues and I find it very bothersome to tell the truth nevertheless I will certainly come back again.

I?m impressed, I need to say. Actually hardly ever do I encounter a blog that?s both educative and entertaining, and let me inform you, you could have hit the nail on the head. Your idea is outstanding; the problem is something that not sufficient persons are talking intelligently about. I’m very completely happy that I stumbled throughout this in my seek for something referring to this.

Oh my goodness! a tremendous article dude. Thanks However I’m experiencing difficulty with ur rss . Don?t know why Unable to subscribe to it. Is there anybody getting an identical rss downside? Anybody who is aware of kindly respond. Thnkx

Excellent post however I was wanting to know if you could write a litte more on this subject? I’d be very grateful if you could elaborate a little bit more. Kudos!

I am not sure where you are getting your information, but good topic. I needs to spend some time learning much more or understanding more. Thanks for great info I was looking for this information for my mission.

There may be noticeably a bundle to find out about this. I assume you made sure good points in features also.

Spot on with this write-up, I really think this web site needs rather more consideration. I?ll in all probability be once more to learn way more, thanks for that info.

Excellent blog! Do you have any tips for aspiring writers? I’m planning to start my own website soon but I’m a little lost on everything. Would you suggest starting with a free platform like WordPress or go for a paid option? There are so many options out there that I’m completely confused .. Any tips? Thank you!

Hey There. I discovered your weblog using msn. This is a very well written article. I?ll be sure to bookmark it and return to learn more of your useful information. Thanks for the post. I?ll certainly comeback.

Some tips i have continually told individuals is that while searching for a good online electronics retail outlet, there are a few issues that you have to consider. First and foremost, you would like to make sure to locate a reputable and also reliable shop that has picked up great testimonials and classification from other consumers and market sector advisors. This will make certain you are getting along with a well-known store that gives good program and aid to its patrons. Thank you for sharing your thinking on this website.

ссылка на интересную статью, рекомендую ознакомиться, перейти на сайт, на русском языке ohktghtlnd … https://intertest.relevantsearchmedia.biz/wp-content/uploads/2024/topoviye_kazino.html

WONDERFUL Post.thanks for share..more wait .. ?